To open long positions on GBP/USD, you need:

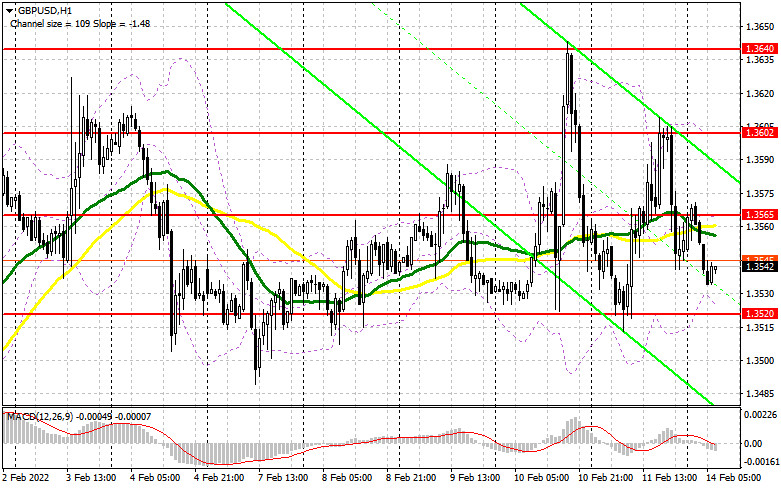

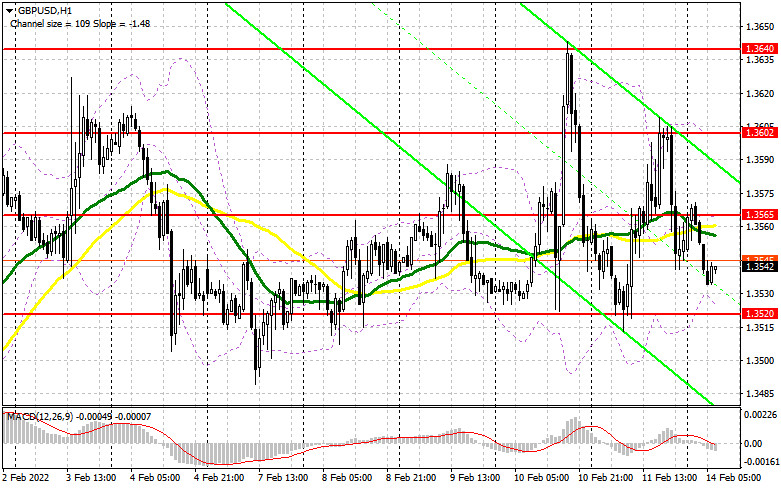

There were quite a few interesting signals on entering the market on Friday. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I paid attention to the level of 1.3515 and advised you to make decisions on entering the market. Monthly UK GDP data for December 2021 put pressure on the pair, which led to a slight decline in the pound in the first half of the day. However, the bulls performed well in the 1.3515 support area and managed to defend this level. Forming a false breakout there led to an excellent entry point into long positions, which caused the pound to grow by 50 points. However, after the resistance test of 1.3558, the initiative was intercepted by the bears. Forming a false breakout there seemed to provide an excellent entry point into short positions in order to resume the fall of the pair, but it did not come to a major downward movement and the pound continued to grow – this led to taking losses on short positions. After a breakthrough and a reverse test of the top-down resistance of 1.3565, an excellent buy signal was formed. As a result, the pair grew by more than 40 points. The most beautiful entry point was short positions after a false breakout in the area of 1.3602 – I paid attention to this level in my afternoon forecast. As a result, the drop was more than 60 points.

Trading remained within the horizontal channel, so Friday's movements did not lead to any special changes from a technical perspective. There are no statistics on the UK today, so I expect the pressure on the pound to remain and the bears will try to cross below 1.3520 again. Protecting this range is an important task for the first half of the day. We can expect the bull market to resume by analogy with last Friday. Forming a false breakout at 1.3520 will provide the first entry point into long positions. An equally important task is a breakthrough and a top-down test of 1.3565, where the moving averages are already playing on the bears' side. This will provide another buy signal with the goal of returning to 1.3602, and the February highs in the area of 1.3640 and 1.3683, where I recommend taking profits, will act as a succeeding target. It will be possible to reach these levels only if traders seriously reconsider their attitude to risky assets. Do not forget that the Bank of England's policy is aimed at tightening monetary policy – this is a good signal for medium-term bulls. In case GBP/USD falls during the European session and a lack of activity at 1.3520, it is better not to rush into buying risky assets. I advise you to wait for the test of the next major level of 1.3477. Forming a false breakout there will provide an entry point to long positions. You can buy the pound immediately on a rebound from 1.3445, or even lower - from a low of 1.3407, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears quickly rehabilitated by the end of the trading week and did not allow the bulls to settle above the resistance of 1.3565 – this is a very important level for determining the pair's short-term direction. Protecting this level is the primary task for today, on which a lot depends. The averages are moving there, so failure to settle above this range creates the first entry point into short positions, counting on a further downward correction to the lower border of the 1.3520 horizontal channel formed last week. A breakthrough and test of 1.3520 from the bottom up in the first half of the day will lead to a major drop in GBP/USD in the area of lows: 1.3477 and 1.3445, where I recommend taking profits. If the pair grows during the European session and bears are weak at 1.3565, it is best to postpone short positions until the next major resistance at 1.3602. I also advise opening short positions there only in case of a false breakout. It is possible to sell GBP/USD immediately for a rebound from a new high of 1.3640, or even higher - from the 1.3683 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report from February 1 showed a sharp increase in short positions and a drop in long ones. This enabled a modest contraction of the positive delta. However, we should understand that the data does not take into account the BoE policy meeting where the regulator hiked the key rate. Nevertheless, it did not help the pound to develop a rally. Traders are well aware that the regulator took a tougher stance on monetary policy to curb rising inflation. Given that the UK economy is going through hard times and at any moment the pace of economic growth may slow down, the British currency did not advance considerably following the interest rate hike. On top of that, the Fed is also expected to raise the benchmark rate in March this year, which will be bearish for GBP/USD. Some analysts believe that the central bank may resort to a more aggressive stance and raise the key rate by 0.5% at once, rather than by 0.25%. The US dollar is sure to take advantage of it. The COT report from February 1 revealed that the number of long non-commercial positions decreased to 29,597 from 36,666, while the number of short non-commercial positions rose to 53,202 from 44,429. This led to an even greater increase in the negative non-commercial net position to -23,605 from -7,763. The weekly closing price declined to 1.3444 from 1.3488.

Indicator signals:

Trading is conducted below the 30 and 50 moving averages, which indicates an attempt by bears to resume the fall of the pound.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the average border of the indicator in the area of 1.3565 will lead to an increase in the pound. Crossing the lower limit in the area of 1.3520 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.