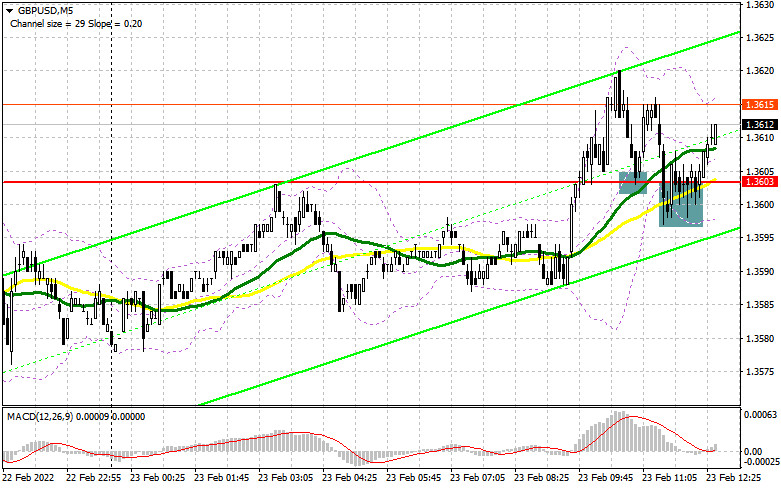

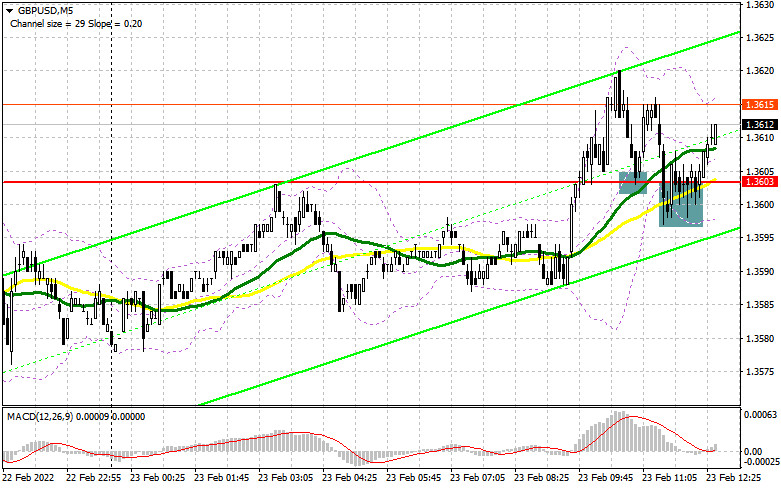

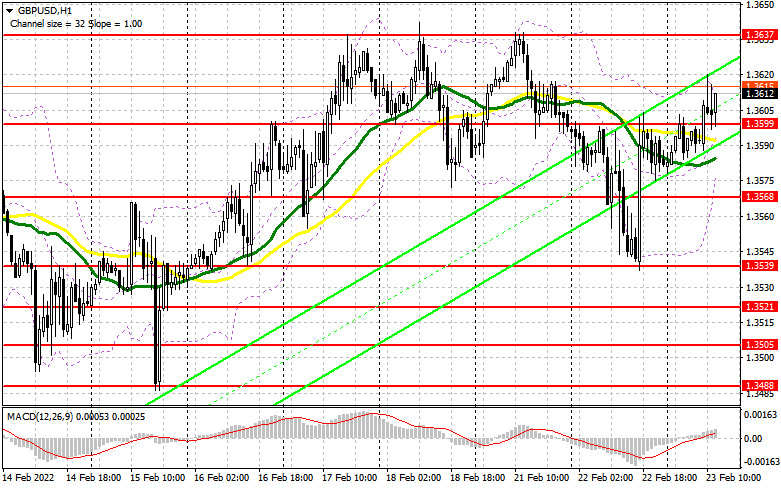

When I made my analysis in the morning, I paid attention to the level of 1.3603 and said you could enter the market from it. Let's take a look at the 5-minute chart and figure out where you could enter the market. An unexpected breakout at 1.3603 and a retest of this mark top-down produced a few buy signals. They are relevant even now, at the moment of writing, although the technical picture on the chart looks different. The hearing of the Bank of England and Governor Andrew Bailey's speech had no effect on the pound whatsoever, providing short-term support for the pound early today.

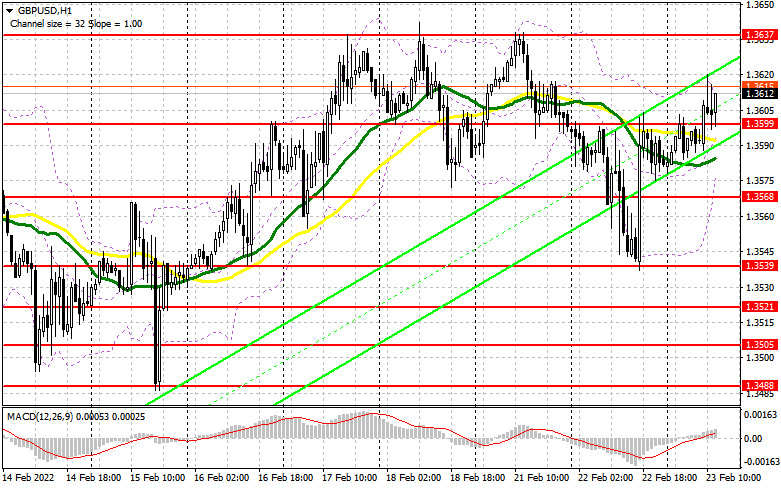

Today, the market will react solely to news about the Russia-Ukraine conflict as no macroeconomic reports will be released in the United States. The pound is likely to extend the rally and even hit a new weekly high if no gloomy news breaks today. Nevertheless, it is important to understand that tensions between Russia and Ukraine are tremendously high and may turn into a military conflict. Under such circumstances, pressure on risk assets, including the pound, is mounting. Therefore, it is now extremely risky to buy the asset. In the North American session, volatility in the market might drop sharply due to the empty macroeconomic calendar in the US. In the second half of the day, bulls will try to protect the support level of 1.3599 needed to maintain bullish sentiment in the market and test the resistance level of 1.3637. Interestingly, the price has tested this level 4 times but has failed to go above it so far. A correction in the North American session and a false breakout at 1.3599 will create the perfect opportunity to go long. A breakout and a test at 1.3637, many sellers count on, as well as a test of this range top-down will produce an additional buy signal with the target at 1.3659. The level of 1.3683 serves as a further target where you should consider taking a profit. If GBP/USD declines in the North American session and bullish activity decreases at 1.3599, it will become possible to go long as soon as the price tests 1.3568 and a false breakout occurs there. You can buy the pound immediately on a bounce from 1.3539 or the low of 1.3521, allowing a 20-25 pips correction intraday.

When to open short positions on GBP/USD:

Since bears did not really fight for the resistance level of 1.3603, they now have to think about how to regain control over the 1.3599 mark. A decrease in bearish sentiment after a sharp rise yesterday and Governor Bailey's speech today indicates bullish sentiment in the market, which may only increase if tensions between Russia and Ukraine ease. So, bears' goal for today will be to protect the resistance level of 1.3637. If bears let the price break above this range, they will lose all their recent gains. A false breakout at 1.3637 will create a strong sell entry point. Bulls should also try to regain control over 1.3599. An additional sell signal will be produced after a breakout and a retest of this level bottom-up with targets at 1.3568 and 1.3539. A further target is seen at 1.3521 where you should consider taking a profit. If GBP/USD rises in the North American session and bearish activity decreases at 1.3637, it is better to wait with selling the pair. You can sell GBP/USD immediately on a bounce from 1.3659 or 1.3683, allowing a correction of 20-25 pips within the day.

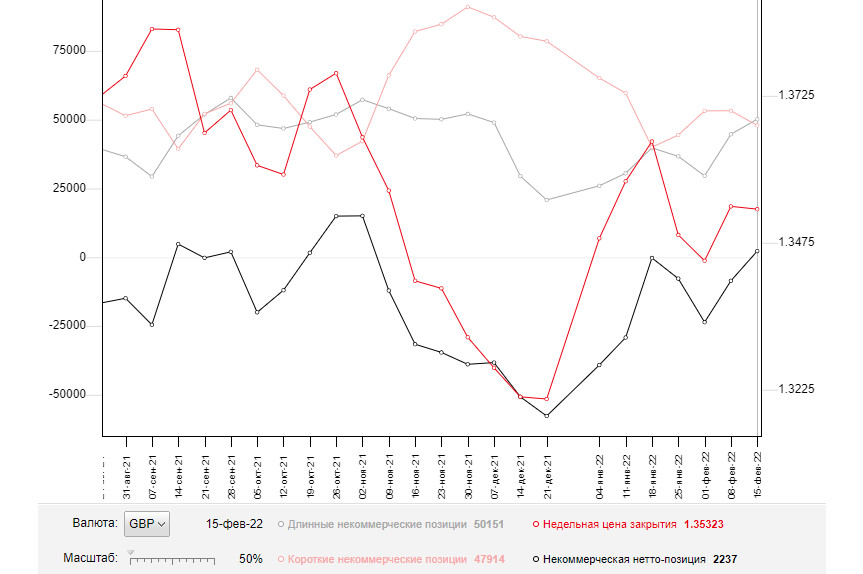

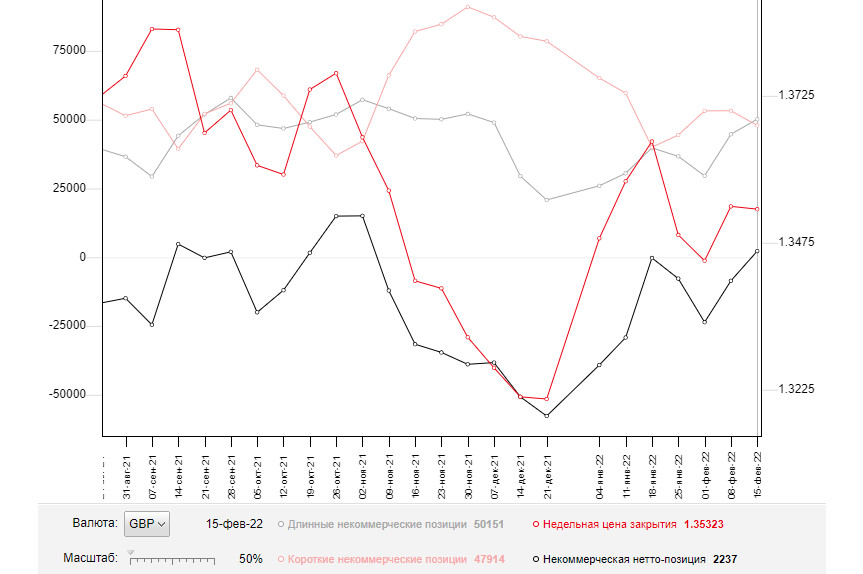

The COT report (Commitments of Traders) as of February 15 logged a sharp increase in long positions and a decrease in short ones, which led to the delta turning positive. The outcome of the Bank of England's meeting came as no surprise to the market. However, the regulator clearly hinted at the likelihood of a more aggressive stance on monetary policy thus fueling risk appetite. The pound would strengthen significantly if it were not for the further escalation of tensions between Russia and Ukraine. In the meantime, it is not clear whether demand for risk assets will stay. Given that the British economy is going through tough times, economic growth might slow down at any time. Moreover, a rate hike might harm the recovery in the short term. However, a strong retail sales report in the UK brings optimism to the market. The fact that inflation stayed firm at the same level in January and remained practically unchanged on a yearly basis may somewhat affect the BoE's monetary policy plans. In addition, geopolitical risks and a possible rate hike by the US Fed in March will be weighing on bulls. Some traders expect the US central bank to hike the rate by 0.5% instead of the planned 0.25% in March, which is a bullish signal for the US dollar. The COT report as of February 15 revealed that long positions of the non-commercial group of traders rose from 44,709 to 50,151, while short positions decreased from 53,254 to 47,914. As a result, the non-commercial net position increased from -8,545 to 2,247. The weekly closing price remained unchanged and stood at 1.3532 against 1.3537.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, indicating the attempt of bulls to gain control over the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

If the pair goes up, the upper band at 1.3610 will serve as resistance. If the price goes down, the lower band at 1.3580 will be seen as support.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.