Dow's Ninth Loss

The U.S. stock market ended Tuesday in negative territory, with the Dow Jones Industrial Average falling for a ninth straight session. This reflects investor caution as they await the Federal Reserve's policy announcement.

Strong Retail Sales Confirm Economic Resilience

U.S. retail sales rose faster than expected in November, driven by a notable increase in auto purchases. This shows that the underlying economic momentum is stable despite continued inflation pressures.

Focus on Fed Decision

Investors are looking ahead to the Fed's statement on Wednesday, which is likely to confirm a 25 basis point rate cut. However, the key takeaway will be an updated economic forecast and comments from Fed Chairman Jerome Powell. These data will help to understand how determined the central bank is to cut rates in 2025.

Easing in Question

The economic situation, despite the current challenges, is showing resilience. Inflation remains elevated, which may force the Fed to be cautious in the pace of monetary easing. Investors are also considering the prospect of stimulus measures from the new Trump administration, which could trigger further price increases.

Amid a strong economy and persistent inflation risks, the Fed will have to find a balance between supporting economic growth and monitoring price stability.

Key Indicators Fall

US stock indices showed negative dynamics on Tuesday:

- Dow Jones Industrial Average (.DJI): down 267.58 points (-0.61%) to 43,449.90;

- S&P 500 (.SPX): down 23.47 points (-0.39%) to 6,050.61;

- Nasdaq Composite (.IXIC): down 64.83 points (-0.32%) to 20,109.06.

Dow: longest streak of declines in decades

Although the Nasdaq index updated record highs on Monday, and the S&P 500 shows an impressive growth of 27% since the beginning of the year, the Dow Jones continues to be under pressure. The ninth consecutive day of decline became the longest period of decline since February 1978.

Bond Market Awaits Fed Decision

Treasury yields remained volatile throughout the day, reflecting investor concerns about the upcoming hawkish Fed announcement. The expected rate cut could be accompanied by signals of further caution.

Market Sectors: Who Gained and Who Lost

Almost all 11 key S&P 500 sectors ended the day in the red. Industrials (.SPLRCI) led the decline, losing 0.9%. However, consumer discretionary stood out, rising 3.6%.

Tesla on High

The sector's gains were led by Tesla (TSLA.O), which jumped on improved forecasts from Mizuho and Wedbush. Both analysts raised their price targets for the company to $515, well above their previous levels.

Volatility Index Rises

The CBOE Volatility Index (.VIX), known as Wall Street's "fear gauge," rose above 15 for the first time in three weeks, closing at 15.87. That's the highest since Nov. 21.

Small Caps Under Pressure

The Russell 2000 (.RUT), a small-cap index, fell 1.2%. These companies are traditionally more sensitive to interest rate changes, making them more vulnerable in the current market environment.

Financial markets continue to show volatility fueled by expectations of the Federal Reserve's decisions. Investors are closely monitoring signals about the future course of monetary policy, which is adding to the jitters in trading.

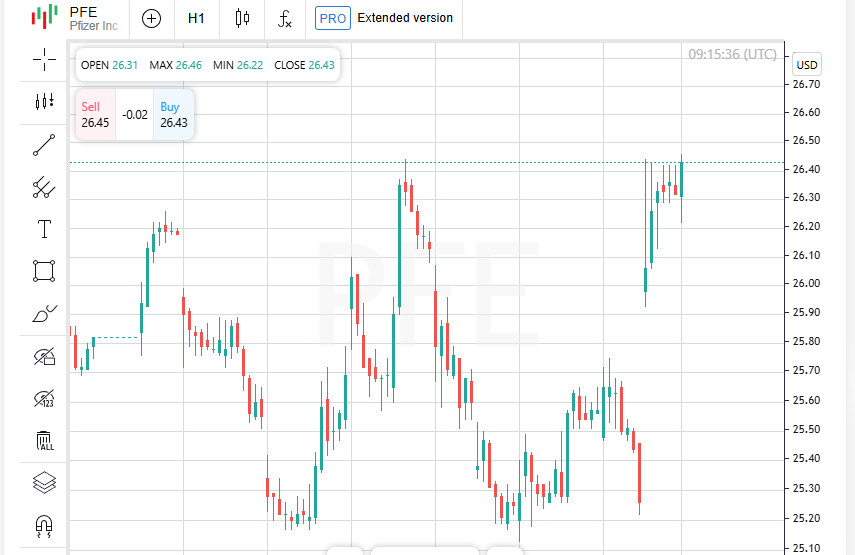

Pfizer Surprises Market, Shares Soar

Shares of Pfizer (PFE.N) rose 4.7% after releasing 2025 profit forecasts. Despite cautious market expectations, the drugmaker's results were in line with Wall Street analysts' forecasts, prompting a positive investor reaction.

The Decline Dominates: Market in the Red

On the New York Stock Exchange (NYSE), the number of stocks that ended the day lower was almost three times greater than the number of those that advanced (a ratio of 2.77 to 1). On the Nasdaq, the picture was slightly less dramatic, but still in favor of the decline - 1.79 to 1.

New Highs and Lows

The market continues to show a divergence in sentiment:

- S&P 500: 11 new 52-week highs and 19 new lows were recorded;

- Nasdaq Composite: 81 new highs and 197 new lows.

Such data indicates instability and duality in investor sentiment, with some assets reaching record highs, while others are experiencing significant pressure.

Trading volumes exceed average values

Trading volume on US exchanges on Tuesday amounted to 16.17 billion shares, which is significantly higher than the average for the last 20 trading days (14.11 billion shares). This increase in activity reflects tension in anticipation of the Federal Reserve's decision.

Bitcoin and bonds: stability in digital and traditional spheres

The cryptocurrency market also did not stand aside: Bitcoin updated its record highs. Meanwhile, U.S. Treasury yields remained steady, suggesting some restraint ahead of the Fed's expected hawkish cut.

Dow's Record Drop: History Repeats Itself

The Dow Jones Industrial Average ended its ninth straight session in the red, its longest losing streak since 1978. The prolonged slide continues to remind the market of the difficulties its blue chips are facing.

Market Expert

Paul Nolte, senior strategist and asset management consultant at Murphy & Sylvest, described the current market environment as a "temporary respite." He said:

"The market is hovering around all-time highs, but we are seeing a clear divergence between growth and value stocks, and between large and small caps. These same trends were present earlier in the year and are resurfacing in the final trading days of 2024." The financial market is currently at a balance point between uncertainty in monetary policy and hopes for further growth. Investors are closely watching the results of the Fed meeting to determine the further strategy.

A number of countries are preparing for their central bank meetings

This week has become a key one for global monetary policy: in addition to the US Federal Reserve, the central banks of Japan, Great Britain, Sweden and Norway will hold meetings.

The Bank of Japan, the Bank of England and the Bank of Norway are expected to maintain current policy parameters, leaving rates unchanged;

The Riksbank (Sweden), on the contrary, is expected to cut rates to support the slowing economy.

These decisions, together with the results of the Fed meeting, will have a significant impact on global financial markets, setting the direction for the coming months.

The Fed: bet on reduction

Members of the Federal Open Market Committee began a two-day meeting on Tuesday, which will end on Wednesday. Most experts and market participants agree that the regulator will cut the base rate by 25 basis points.

However, it is not only the rate cut itself that will be an important event. Investors are awaiting the publication of the accompanying document - the Summary of Economic Projections (SEP). This report can shed light on the Fed's plans for the coming year, especially in the context of high inflation and strong economic data that allow monetary policy to remain tight.

What the experts say

Robert Pavlik, senior portfolio manager at Dakota Wealth, believes that the current rate cut by the Fed is a step dictated by both market expectations and the regulator's own commitments.

"The rate cut is already priced in. The Fed should have acted within the framework of its previous promises, given the market consensus," he noted.

Next, according to Pavlik, the Fed will most likely pause in its actions to wait for clearer signals about the slowdown in inflation.

Global Outlook

The decisions of U.S. and other central banks will set the direction of the global economy amid growing concerns about price volatility and the growth gap between developed and emerging markets.

Investors around the world are watching the meetings closely, recognizing that the conditions are now taking shape that will shape market dynamics and monetary policy strategy in 2025.

U.S. consumers are supporting the economy

The latest U.S. retail sales report beat analysts' estimates, demonstrating the strength of the U.S. economy. The figure confirms that consumer spending continues to drive growth despite inflationary pressures and monetary tightening.

Contrast with China: Threat to global demand

At the same time, China, the world's second-largest economy, showed a marked weakening in retail sales. The weak data sent a worrying signal to global markets, highlighting that China's demand recovery faces significant headwinds.

A mixed signal for the global economy

The contrast between the resilience of the US consumer and the slowdown in Chinese demand is heightening concerns about imbalances in the global economy. If domestic demand in the US continues to support growth, this could partly offset the weakening of global demand, but the long-term outlook depends on the recovery of Asian markets.

Experts warn that the current situation requires a balanced approach from global central banks, as strong data in some regions may not neutralize negative trends in others.

Energy and healthcare drag the market down

European stock indices hit two-week lows on Tuesday. The fall was felt most strongly in the energy and healthcare sectors, which came under pressure amid expectations of central bank decisions and weak economic data from China.

Global indices in the red

- MSCI World (.MIWD00000PUS): down 3.86 points (-0.44%), to 863.98;

- STOXX 600 (.STOXX): down 0.42%;

- FTSEurofirst 300 (.FTEU3): down 7.75 points (-0.38%);

- MSCI Emerging Markets Index (.MSCIEF): down 9.32 points (-0.84%) to 1093.89;

- MSCI Asia Pacific ex Japan (.MIAPJ0000PUS): down 0.63% to 579.66;

- Nikkei (.N225): Japan closed down 92.81 points (-0.24%) to 39364.68.

Weak data from China, a key demand driver, has heightened concerns about global economic growth, weighing on investor sentiment around the world.

Bond yields: down ahead of Fed decisions

The US bond market also reacted cautiously. The yield on the 10-year Treasury note fell to 4.395%, retreating from a three-week high set the previous day.

- The 10-year note: down 0.4 basis points, from 4.399% to 4.395%;

- The 30-year note: down 2.6 basis points, from 4.61% to 4.5837%.

These moves reflect market participants' expectations ahead of the Fed meeting, which could be the key event of the week.

Central banks and the China factor

This week promises to be a busy one for global markets as participants await decisions from the Fed, the Bank of England and other policymakers. At the same time, negative data from China is adding to the uncertainty, adding pressure to already volatile markets.

Investors will be watching closely for further statements from central banks, which could provide more clarity on future policy amid weakening global demand.

Dollar Retains Strength Amid Economic Data

The U.S. currency showed a slight increase against a basket of global currencies after the publication of retail sales data that beat expectations, bolstering confidence that the U.S. economy maintains momentum. However, market participants continue to assess the possibility of a more gradual rate cut by the Federal Reserve next year.

- The dollar index rose 0.18%, reaching 106.98;

- The euro weakened 0.22%, falling to $1.0487;

- The yen strengthened against the dollar, which fell 0.42% to 153.51.

Cryptocurrencies: Bitcoin continues to rise

Bitcoin has renewed its record highs amid growing investor interest and discussions about the creation of a strategic bitcoin reserve in the United States, proposed by President-elect Donald Trump.

- Bitcoin (BTC): up 0.52%, to $106,635.28;

- Ethereum (ETH): down 2.83% to $3,933.80.

These swings highlight the growing role of cryptocurrencies in the global economy, although volatility remains significant.

Oil prices fall amid demand concerns

World oil prices fell, reacting to weak economic data from Germany and China, which increased concerns about a slowdown in global demand.

- WTI (US crude): down 0.89% to $70.08 per barrel;

- Brent (North Sea blend): down 0.97% to $73.19 per barrel.

The data once again raises questions about the balance of the global oil market, where the prospects for a recovery in demand are confronted by economic instability.

Gold under pressure from a strong dollar

Gold prices fell as a stronger dollar and expectations of a modest rate cut by the Federal Reserve next year reduced the metal's appeal as a safe haven asset.

- Spot gold: down 0.32% to $2,643.84 an ounce;

- Gold futures (US): down 0.48% to $2,638.80 an ounce.

Metals markets remain closely linked to the US dollar, making gold sensitive to changes in Fed policy.

Looking ahead

Financial markets are mixed, with the dollar and cryptocurrencies rising while oil and gold prices fall. Amid ongoing uncertainty in the global economy, investors continue to monitor central bank policies and key economic indicators.