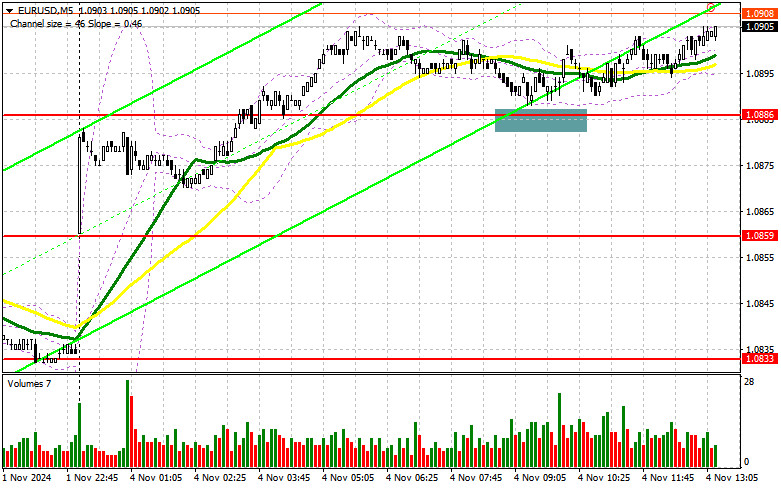

In my morning forecast, I highlighted the 1.0886 level and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happened. Although there was a decline, there was no test or formation of a false breakout there, which left me without entry points in the first half of the day. The technical outlook for the second half of the day has not been revised.

To Open Long Positions on EUR/USD:

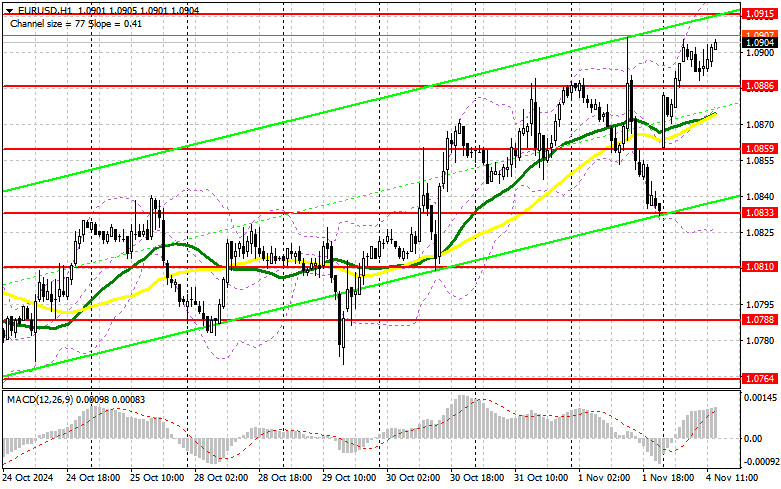

The manufacturing activity data did not significantly harm the euro. Given that only the U.S. report on changes in factory orders will be released during the U.S. session, buyers are unlikely to face significant issues with continuing the uptrend. If the pair declines, I plan to act similarly to the first half of the day. Only the formation of a false breakout around 1.0886, where the moving averages are located slightly below, will be a suitable condition for increasing long positions to continue growth, aiming for the 1.0915 level, which has not yet been reached today. A breakout and retest of this range will confirm the correct entry point for purchases, aiming for an update of 1.0935. The farthest target will be the 1.0952 high, where I will take profit. In case of a decline in EUR/USD and no activity around 1.0886 in the second half of the day, the euro risks a significant fall. In such a scenario, I will only enter after forming a false breakout around the next support at 1.0859. I plan to open long positions immediately on a rebound from 1.0833, targeting an upward correction of 30-35 points within the day.

To Open Short Positions on EUR/USD:

Sellers will count on defending the 1.0915 resistance. The formation of a false breakout there will provide an entry point for short positions, with the prospect of a decline to the 1.0886 support, which was barely missed in the first half of the day. A breakout and consolidation below this range, along with a retest from bottom to top, will be another suitable scenario for selling, targeting the 1.0859 level, which will negate buyers' growth plans. The farthest target will be the 1.0833 level, where I will take profit. If EUR/USD rises in the second half of the day and there is no bearish activity at 1.0915, which is more likely, buyers will have a chance to build a new uptrend. In that case, I will defer selling until the next resistance at 1.0935 is tested. I will also sell there but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.0952, targeting a downward correction of 30-35 points.

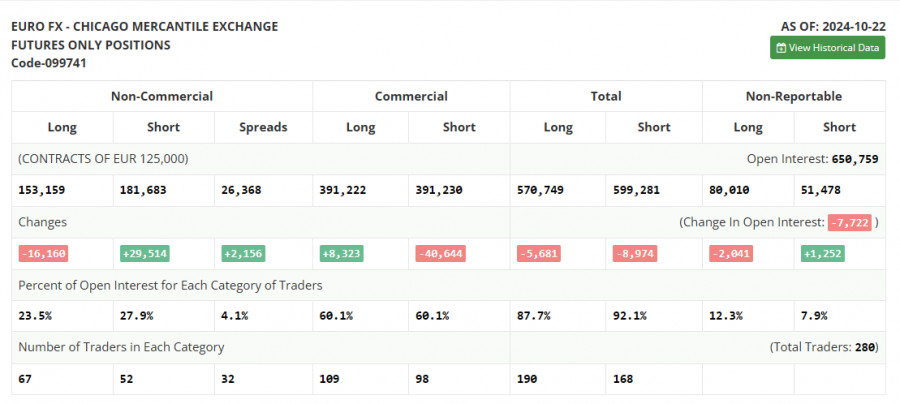

In the Commitment of Traders (COT) report for October 22, there was another sharp increase in short positions and a further decrease in long positions. It is evident that everyone is preparing for an aggressive rate cut by the European Central Bank, a topic frequently mentioned by European policymakers, as well as for a more cautious approach by the Federal Reserve in this regard. Most likely, this week's U.S. GDP and labor market data will set the record straight, convincing markets that there is no need for further aggressive rate cuts, which will provide additional support for the dollar. The COT report indicated that long non-commercial positions decreased by 16,160 to 153,159, while short non-commercial positions increased by 29,514 to 181,683. As a result, the gap between long and short positions increased by 2,156.

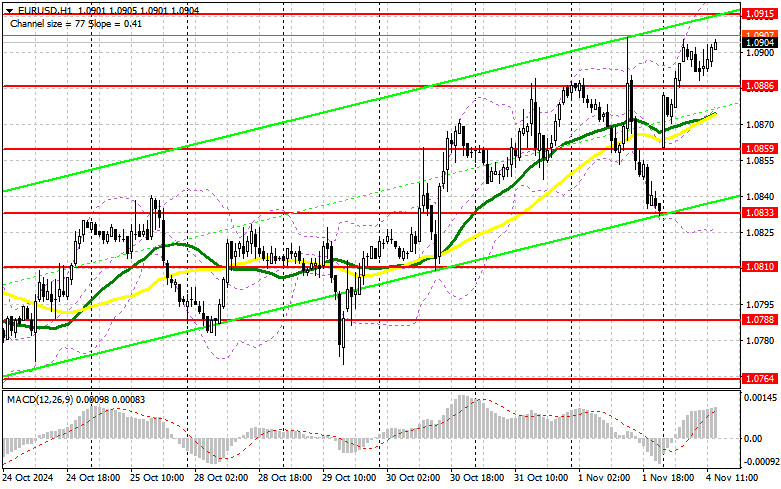

Indicator Signals:

Moving Averages

Trading is conducted above the 30- and 50-day moving averages, indicating continued growth for the pair.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the classical definition of daily moving averages on the D1 daily chart.

Bollinger Bands

In the event of a decline, the lower boundary of the indicator around 1.0833 will serve as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing out volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: Represent the total long open position held by non-commercial traders.

- Short non-commercial positions: Represent the total short open position held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial traders' short and long positions.