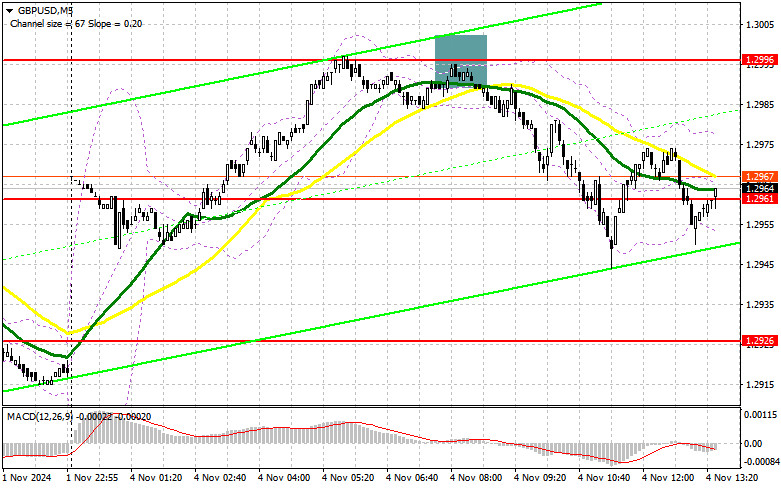

In my morning forecast, I highlighted the 1.2996 level and planned to make trading decisions from it. Let's look at the 5-minute chart and review what happened. The rise and formation of a false breakout around 1.2996 created an excellent entry point for selling the pound, leading to a 50-point drop in the pair. The technical outlook was revised for the second half of the day.

To Open Long Positions on GBP/USD:

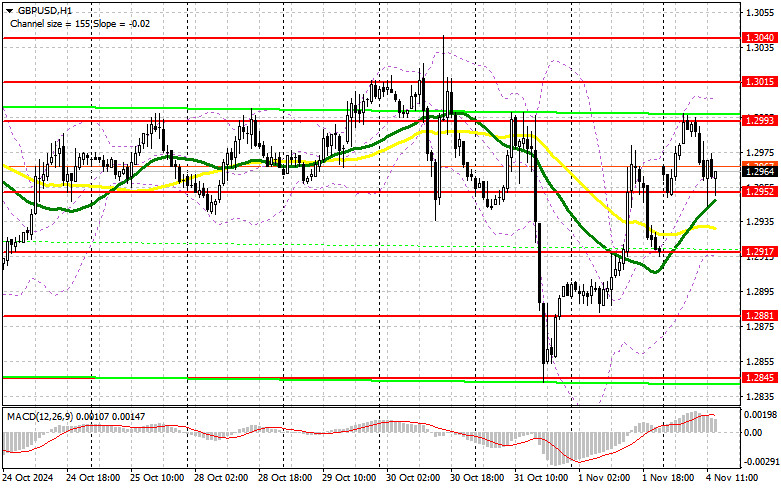

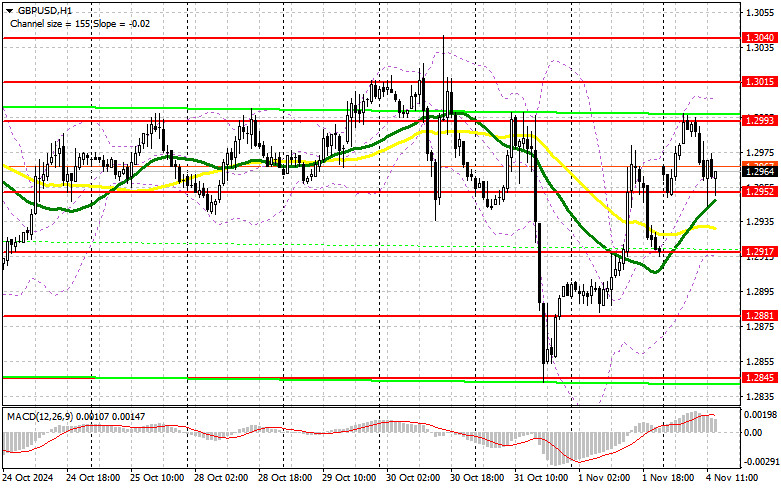

The change in U.S. factory orders is all that awaits us during the U.S. session. Therefore, despite difficulties in breaking above the weekly high, pound buyers still have a chance for growth. A more optimal scenario would be a decline and formation of a false breakout around the new support at 1.2952, formed after the first half of the day. This would confirm the correct entry point for long positions aimed at recovery towards 1.2993. A breakout and retest of this range would lead to a new entry point for long positions, with the potential to update 1.3015. The farthest target would be the 1.3040 level, where I plan to take profit. If GBP/USD declines and there is no activity from the bulls around 1.2952 in the second half of the day, the bearish market will return, leading to a drop and an update to the next support at 1.2917. Only the formation of a false breakout there would provide a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2881 low, aiming for a 30-35 point intraday correction.

To Open Short Positions on GBP/USD:

Sellers are active, indicating intentions to restore the bearish market observed last week following news of tax increases in the UK. If the pair rises again after U.S. data, bears must show up again around the nearest resistance at 1.2993. The formation of a false breakout there, similar to the one discussed earlier, would be a suitable scenario for selling, aiming for a drop to the 1.2952 support, bringing the pair back into a sideways channel. A breakout and retest of this range from below would pressure buyers' positions, triggering stop orders and paving the way to 1.2917. The farthest target would be the 1.2881 level, where I will take profit. Testing this level will reinforce the bearish market. If GBP/USD rises and there is no bearish activity at 1.2993 amid weak U.S. statistics, buyers will try to reach last week's highs. Bears will have no choice but to retreat to the 1.3015 resistance area. I will only sell there after a failed consolidation. If there is no downward movement, I will look for short positions on a rebound around 1.3040, aiming for a 30-35 point intraday correction.

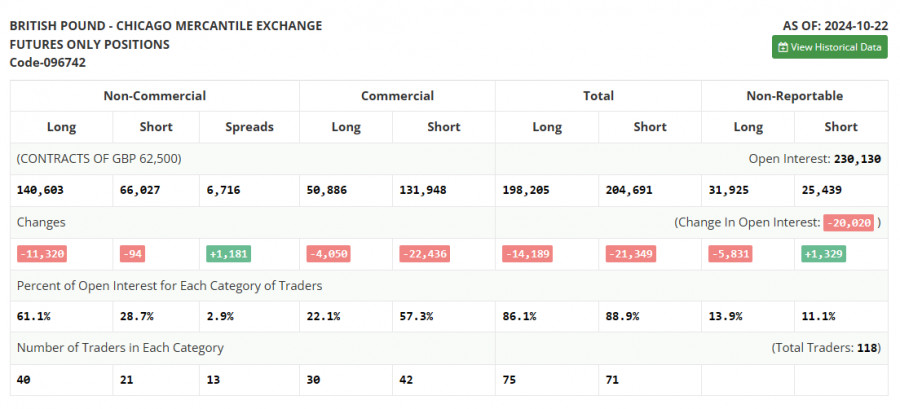

The COT (Commitment of Traders) report for October 22 showed a reduction in both long and short positions. However, the decrease in buyers did not significantly affect the market balance, as they still outnumber sellers by nearly two and a half times. This week, there is no significant economic data for the UK, and given that British policymakers have said all they could, I expect the pound to continue recovering against the dollar. However, much depends on U.S. GDP and labor market data, so these figures should not be overlooked. The latest COT report indicated that long non-commercial positions fell by 11,320 to 140,603, while short non-commercial positions dropped by only 94 to 66,072. As a result, the gap between long and short positions increased by 1,181.

Indicator Signals:

Moving Averages

Trading occurs above the 30- and 50-day moving averages, indicating a rise in the pound.

Note: The period and prices of the moving averages are considered by the author on the H1 hourly chart and differ from the classical definition of daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator around 1.2917 will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing volatility and noise. Period – 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: Represent the total long open positions held by non-commercial traders.

- Short non-commercial positions: Represent the total short open positions held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial traders' long and short positions.