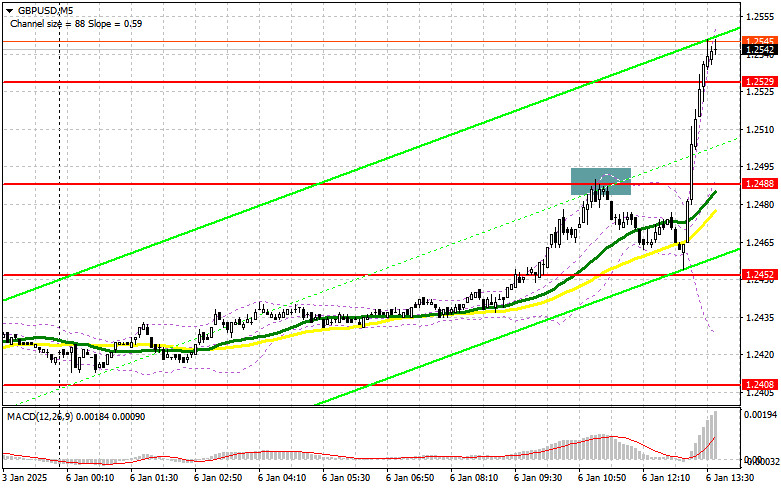

In my morning forecast, I focused on the level of 1.2488 and planned to make trading decisions based on it. Let's analyze the 5-minute chart and review what happened. A rise and a false breakout at this level provided a good entry point for short positions, leading to a 30-point drop in the pair. The technical picture has not been revised for the second half of the day.

To Open Long Positions on GBP/USD:

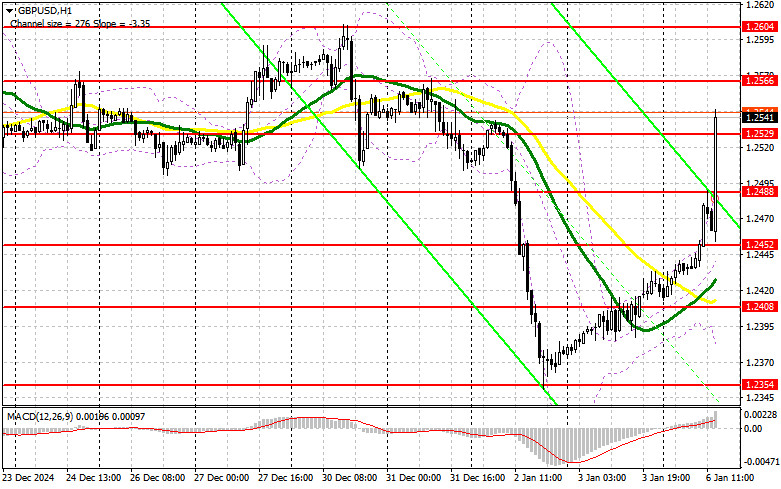

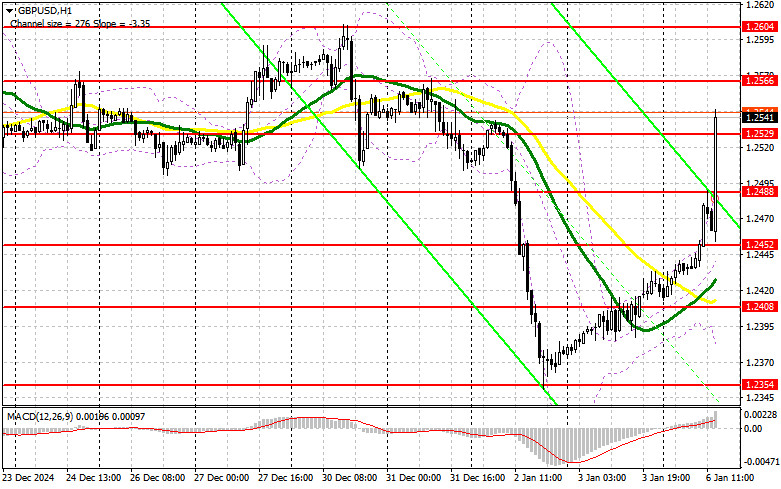

Despite mediocre data on UK services activity, demand for the pound remained steady. This indicates that traders are no longer as eager to sell GBP/USD as they were at the start of the year. In the second half of the day, we expect data on the US services PMI, the composite PMI, and a speech by FOMC member Lisa D. Cook. Only very strong data can bring back pressure on the pound. Even if the pair declines, I anticipate buyers near 1.2488. A false breakout at this level will provide a good entry point for purchases, targeting a recovery toward resistance at 1.2529, where trading is currently concentrated. A breakout and retest of this range from above will serve as a new entry point for long positions with the prospect of reaching 1.2566, where buyers are likely to face challenges. The ultimate target will be the level of 1.2604, where I plan to take profits.

If GBP/USD declines and bulls show no activity around 1.2488, buyers will lose initiative, likely causing the pair to stagnate in a sideways channel. In that case, a false breakout around the next support at 1.2452 will be a suitable condition for opening long positions. I will consider buying GBP/USD immediately on a rebound from the low at 1.2408, targeting a 30–35 point intraday correction.

To Open Short Positions on GBP/USD:

Pound sellers are hesitant to take action, even though they showed some activity around 1.2488. A clear reluctance by major players to sell the pound further led to the sharp rise in GBP/USD, making serious bearish prospects unlikely for now. If the pair rises again after the data, bears will have to contend with the level of 1.2529, and breaking through it would create significant problems for the bearish trend. A false breakout at this level will provide an opportunity to increase short positions, aiming for a decline toward 1.2488. A breakout and retest of this range from below will trigger stop-losses, opening the path to 1.2452, which would be a serious blow to bulls' positions. The ultimate target will be the level of 1.2408, where I plan to take profits.

If demand for the pound persists after US data and sellers fail to act around 1.2529, buyers will have a good chance for a new wave of growth. Bears will have no choice but to retreat to resistance at 1.2566. I will sell there only after a false breakout. If there is no downward movement at that level, I will look for short positions on a rebound from 1.2604, but only for a 30–35 point downward correction intraday.

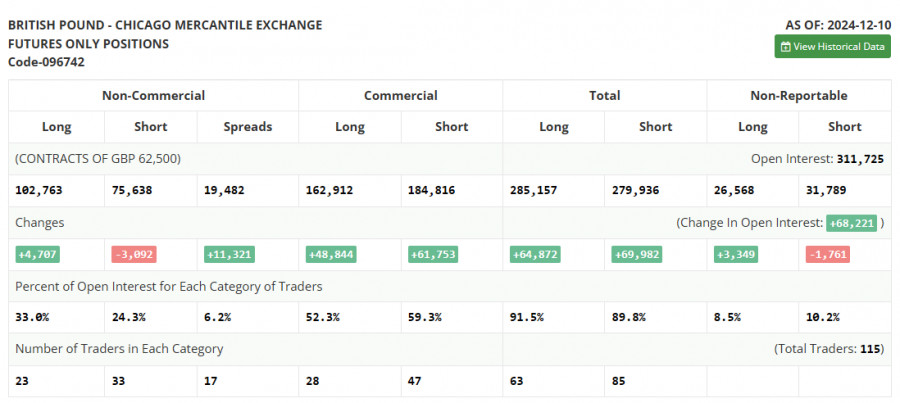

The Commitment of Traders (COT) report for December 10 showed a decrease in short positions and an increase in long ones. Overall, the market forces remained unchanged, as many traders adopted a wait-and-see approach ahead of the Bank of England's year-end meeting. The decision on interest rates remains uncertain. Recent GDP and inflation data have put the regulator in a very challenging position, forcing traders to act cautiously. The latest COT report indicated that long non-commercial positions rose by 4,707 to 102,763, while short non-commercial positions decreased by 3,092 to 75,638. As a result, the gap between long and short positions increased by 11,321.

Indicator Signals:

Moving Averages:

Trading is above the 30- and 50-day moving averages, indicating a new wave of pair growth.

Note: The moving average periods and prices referenced are on the hourly H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator at 1.2400 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise.

- 50-period MA: Highlighted in yellow on the chart.

- 30-period MA: Highlighted in green on the chart.

- MACD Indicator: (Moving Average Convergence/Divergence – EMA convergence/divergence).

- Fast EMA – 12-period.

- Slow EMA – 26-period.

- Signal SMA – 9-period.

- Bollinger Bands: A 20-period indicator.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes, meeting specific criteria.

- Long Non-commercial Positions: Represent the total long open positions of non-commercial traders.

- Short Non-commercial Positions: Represent the total short open positions of non-commercial traders.

- Net Non-commercial Position: The difference between the short and long positions of non-commercial traders.