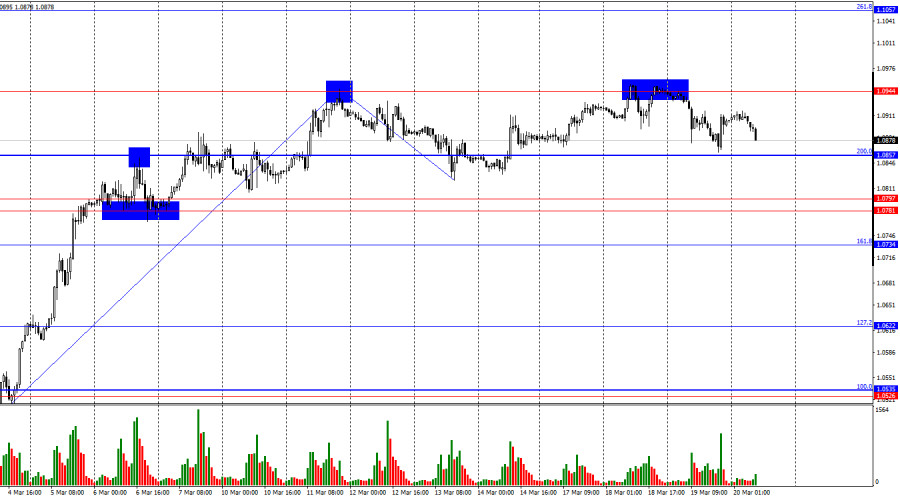

On Wednesday, the EUR/USD pair rebounded from the 1.0944 level for the third time and reversed in favor of the U.S. dollar, declining toward the 200.0% Fibonacci level at 1.0857. A rebound from this level would once again favor the euro and lead to renewed growth toward 1.0944. A firm consolidation below 1.0857 would increase the likelihood of a continued decline towards the support zone at 1.0781–1.0797, signaling the beginning of a bearish trend.

The wave structure on the hourly chart has shifted. The last downward wave did not break the previous low, while the latest upward wave surpassed the previous peak, but only by a few pips. This suggests that the bullish trend is still in place, but a reversal may be imminent, as bulls appear to be losing momentum. Donald Trump's tariffs have pressured the dollar for weeks, but even the bulls now need a break.

Wednesday's fundamental backdrop was quite interesting. I won't go into every report of the day because the main event occurred in the evening. The FOMC left interest rates unchanged, and committee members confirmed their plan to cut rates twice in 2025. However, several FOMC members turned more hawkish, now expecting only one rate cut this year. In my view, this represents a hawkish shift in Fed sentiment, yet the dollar failed to react accordingly. Jerome Powell stated during his press conference that inflation this year may be higher than expected and that Trump's tariffs add uncertainty to markets and the economy. The Fed Chair did not speculate on how trade policy might impact growth, inflation, or GDP, but he reaffirmed that the U.S. economy remains strong and that the Fed is fully committed to bringing inflation back to 2%. The Fed's meeting results were slightly more hawkish than expected, yet this had no immediate impact on the dollar—at least not yesterday.

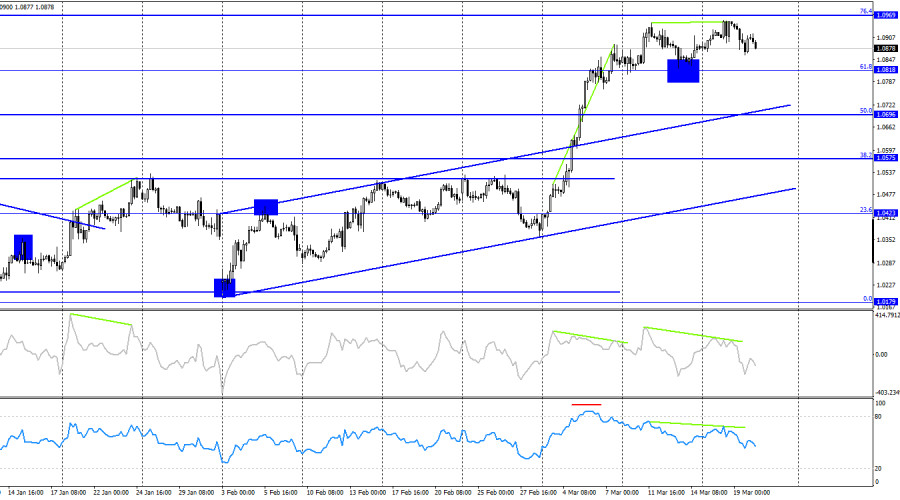

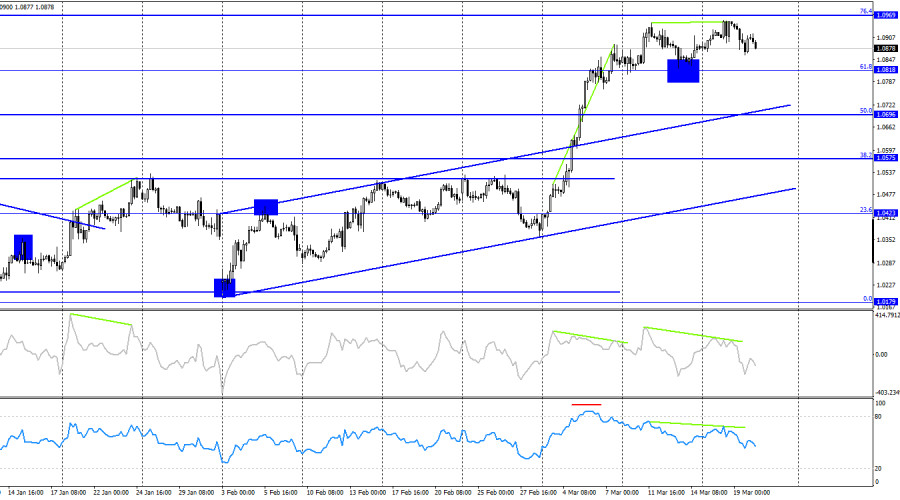

On the 4-hour chart, the pair continues its upward movement after breaking above the horizontal range. The trend is now bullish, as indicated by the ascending trend channel. A rejection from the 61.8% Fibonacci level at 1.0818 suggests further growth toward the next retracement level at 76.4% – 1.0969. However, bearish divergences are forming on the CCI and RSI indicators, signaling a potential upcoming decline. On the hourly chart, a correction is also looming. The Fed has provided the dollar with an opportunity to strengthen, and this move may have already begun.

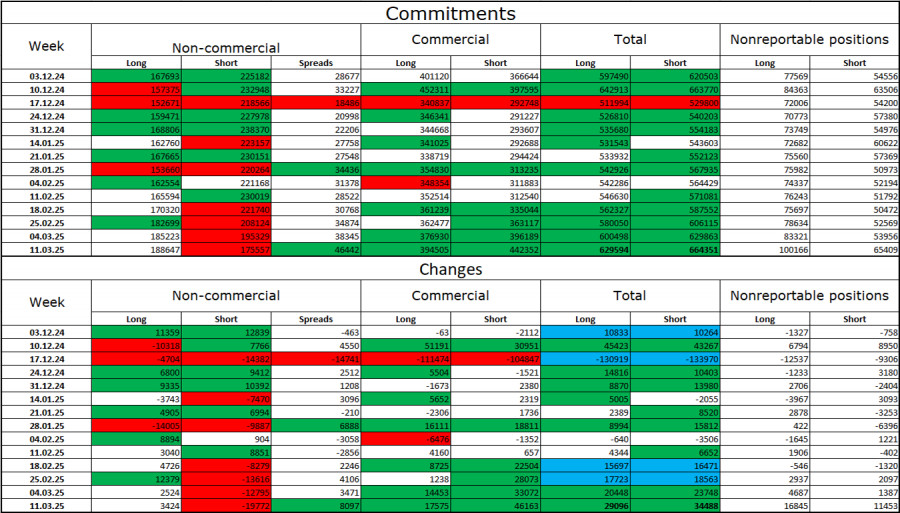

Commitments of Traders (COT) Report:

Over the last reporting week, professional traders opened 3,424 long positions and closed 19,772 short positions. This shift has returned the "Non-commercial" category to a bullish stance—thanks to Donald Trump. The total number of long positions held by speculators now stands at 188K, while short positions amount to 175K.

For twenty consecutive weeks, institutional players were selling euros, but for the past five weeks, they have been reducing short positions and adding to long positions. The divergence in monetary policy between the ECB and the Fed suggests that the rate differential should favor the dollar, but Trump's trade policies have become a more decisive factor for traders. His policies may force the Fed into a more dovish stance and increase recession risks in the U.S. economy.

Economic Calendar for the U.S. and the Eurozone:

Eurozone:

- ECB President Christine Lagarde's speech (08:00 UTC)

United States:

- Initial jobless claims (12:30 UTC)

- Philadelphia Fed Business Outlook Index (12:30 UTC)

- Existing home sales (14:00 UTC)

On March 20, the economic calendar contains four key events, though only Lagarde's speech is of significant importance. The overall fundamental impact on market sentiment may be weak on Thursday.

EUR/USD Forecast and Trading Advice:

Sell positions were possible on a rejection from 1.0944 on the hourly chart, with targets at 1.0857 and 1.0797. These trades can remain open for now. Buy positions can be considered, but I remain cautious about the pair's strong and nearly uninterrupted rally. I am skeptical about one-directional movements like this. At this point, I believe the trend is starting to shift in favor of the bears.

Fibonacci retracement levels are built from 1.0529 to 1.0213 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.