To open long positions on GBP/USD, you need:

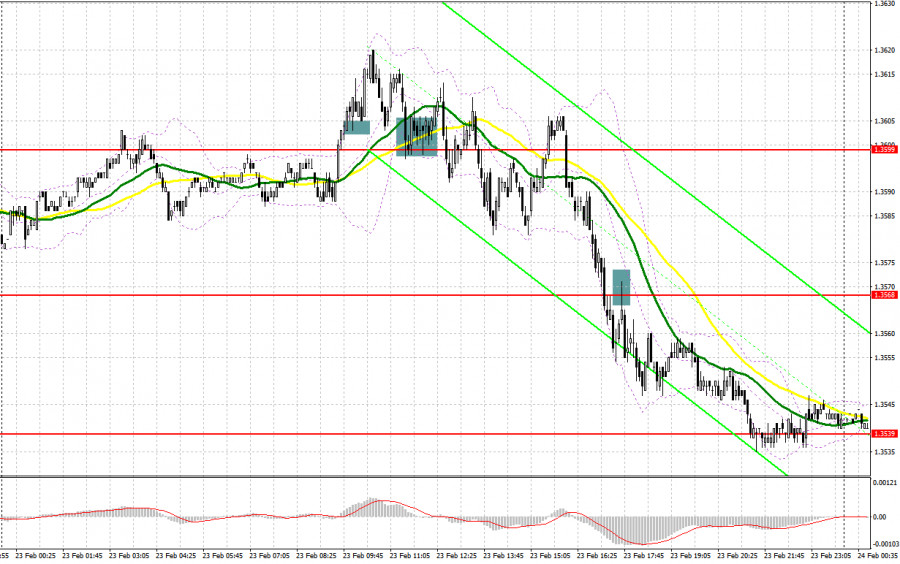

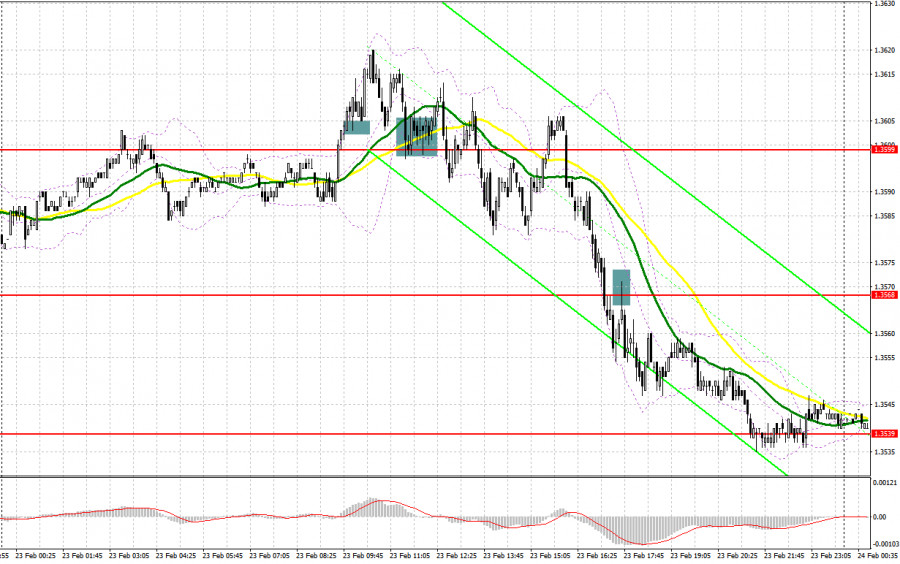

Yesterday, several good signals were formed to enter the market. Let's take a look at the 5-minute chart and figure out where it was possible and necessary to enter. In my morning forecast, I paid attention to the level of 1.3603 and advised you to make decisions on entering the market. A sharp breakthrough of 1.3603 and a reverse test from top to bottom - all this resulted in forming several signals to buy the pound, but it did not lead to a major upward movement of the pair. Despite the fact that the parliamentary hearings on the Bank of England report and Governor Andrew Bailey's speech concerned the high level of inflation, against the background of geopolitical risks, pound bulls were in no hurry to build up long positions, and they were right. The pound's downward movement in the afternoon and the reverse test of 1.3568 - all this led to an excellent entry point into short positions. As a result, the pound collapsed by more than 60 points.

The pound collapsed against the US dollar during the Asian session due to Russia's military actions on the territory of Ukraine. The escalation of the conflict has moved into the armed stage, which greatly affects risky assets. So far, there is no need to talk about any fundamental background, since all attention will be on the further actions of the Russian authorities and retaliatory measures by the EU and the United States. A report on retail sales in the UK is coming out today, but it is unlikely to support the pound even if it happens that sales will be much higher than economists' forecasts. In normal times, this would be a powerful bullish signal, especially in the context of the Bank of England's current struggle with high inflation.

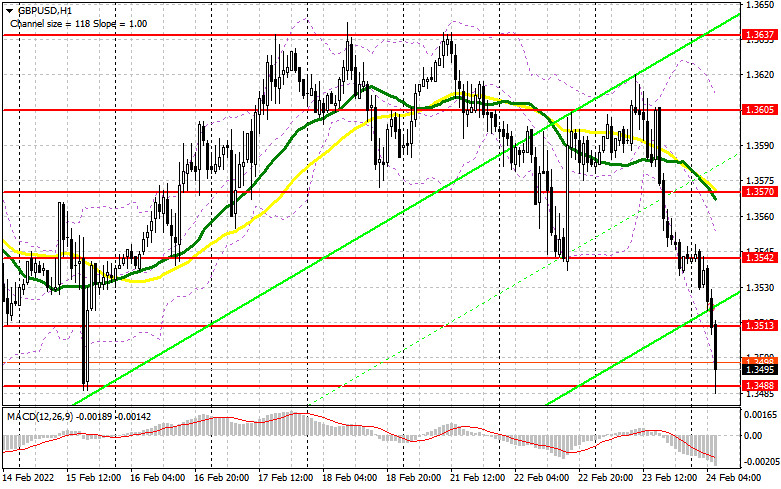

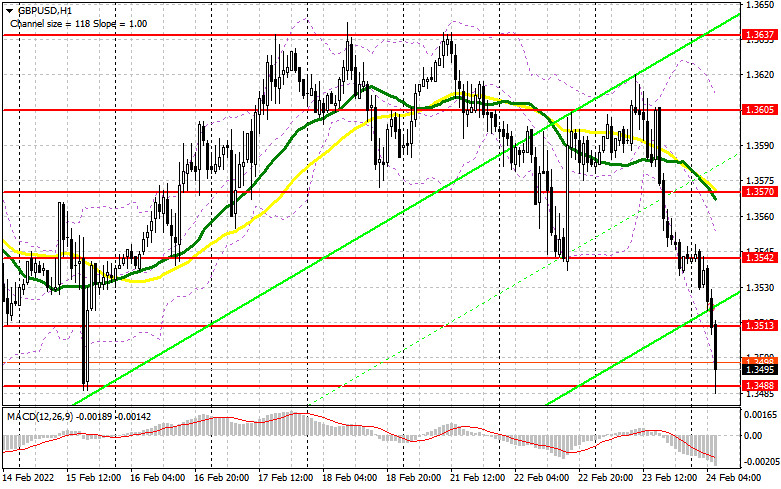

It is important to protect the support of 1.3477 during the European session, to which the pound will probably collapse today, even despite the good retail sales data. Bailey's speeches in the first half of the day may limit the pair's downward potential, which will allow the pound to remain within a wide horizontal channel. You can consider long positions from 1.3477 only after forming a false breakout there, which will lead to a wave of growth in the resistance area of 1.3513, formed by today's results. A breakthrough and a test of this range from top to bottom, by analogy with yesterday, creates another buy signal with the pair recovering to today's high at 1.3542. A more distant target will be the 1.3570 area, where the moving averages are playing on the bears' side. I recommend taking profits there. In case GBP/USD falls during the European session and the bulls are not active at 1.3477, it is best not to rush with long positions, since the intensification of the military conflict will not end well. The nearest support in this case will be the 1.3446 area. Forming a false breakout there will provide an entry point to long positions. You can buy GBP/USD immediately on a rebound from 1.3407, or even lower - from a low of 1.3384, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears are in full control of the market and are ready to be more active as soon as news of retaliatory sanctions and measures against Russia from the EU and the United States appears. The nearest target will be the support of 1.3477. A breakthrough and a reverse test of this range will increase pressure on the pair, which will provide another entry point into short positions with the goal of falling to new lows: 1.3446 and 1.3407. A more distant target will be the 1.3384 area, where I recommend taking profits. In case GBP/USD grows during the European session, I advise you to take a closer look at short positions in the area of the intermediate resistance of 1.3513, formed by today's results. Forming a false breakout at this level will provide a good entry point into short positions. In case the bears are not active at 1.3513, it is best to postpone short positions to a larger level of 1.3542. I also advise you to open short positions there in case of a false breakout. You can sell GBP/USD immediately for a rebound from 1.3570, where the moving averages playing on the bears' side are, or even higher - from the high of 1.3605, counting on the pair's correction down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for February 15 showed that long positions sharply increased while short ones decreased. This led to the return of the delta of its positive value. Although the results of the Bank of England meeting did not come as a surprise, clear hints from the central bank on a more aggressive tightening of monetary policy clearly fuels the appetite for risks on the part of major players. If it were not for the ongoing conflict between Russia and Ukraine, which has reached a new level, one could count on a more active recovery of the pound. In the meantime, further demand for risky assets is questionable. Given that the British economy is currently going through not the best of times and at any moment the pace of economic growth may seriously slow down - an increase in rates may harm the pace of recovery in the near future. However, optimism is inspired by the recent good report on retail sales, which implies a strong growth in the indicator. The fact that inflation in January remained at the same levels and practically did not change year-on-year - all this may affect the BoE's plans, which will moderate the pace of policy tightening. Further geopolitical events around Russia and Ukraine, as well as the decisive actions of the Federal Reserve regarding future interest rates in March of this year – all this will continue to put pressure on pound bulls. Some traders expect that the US central bank may resort to more aggressive actions and raise rates by 0.5% at once, rather than by 0.25% — this will become a kind of bullish signal for the US dollar. The COT report for February 15 indicated that long non-commercial positions increased from 44,709 to 50,151, while short non-commercial positions decreased from 53,254 to 47,914. This led to an increase in the non-commercial net position from -8,545 to 2,247. The weekly closing price remained unchanged at 1.3532 versus 1.3537.

Indicator signals:

Trading is below the 30 and 50 moving averages, indicating a bear market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the average border of the indicator in the area of 1.3542 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.