The pound sterling went up yesterday after important macroeconomic data had been published. Judging by what is currently going on in the market, bulls are preparing to extend the rally.

Traders were focused on BoE Governor Bailey's speech yesterday. The BoE's boss said inflationary pressure might improve, citing surging energy costs and signs that cost pressures are feeding into wage demands.

Curbing inflation

Mr. Bailey sees extra risks from Russia-Ukraine tensions, which could cause a longer-lasting rise in natural gas prices. The governor has a point. Indeed, the consumer price index accelerated to 5.4% on annual terms, yesterday's data showed. The UK saw inflation rising to its highest level since 1992.

Mr. Bailey also noted a darkening picture on wages, saying that the county might face stagflation, that is, when growing prices fully offset wage increases from employers. In other words, wages and prices continue rising.

Under such conditions, the Bank of Englan is expected to raise the interest rate to 0.5% in February in an attempt to curb inflation.

A record number of vacancies are exerting pressure on wages as the consequences of the latest Covid wave and Omicron are not as severe as they could have been. This allowed the UK labor market to stay aloft which was confirmed by the recent unemployment results. So, the unemployment rate in the country fell to 4.1%. Wages are not expected to grow the way prices do and they will not surpass inflation. Consequently, household earnings will decline, affecting costs and the pace of economic recovery.

Bailey also noted that companies now have to pay new employees higher wages, which could lead to a surge in inflation.

Speaking of natural gas, market expectations for future prices increased since the BoE last made its projections in November 2021. It is commonly known that energy is a significant component of the consumer price index. So, the regulator now forecasts gas prices to remain high throughout 2023, a year longer expected. The new outlook also touches on growing tensions between Russia and NATO over the Ukrainian border. "If we are going to have a more elevated gas price, that is a source of concern. I have to be honest," the BoE governor said.

Standards of living in the UK

The cost of living crisis that households might face this year could, on its own, lower inflation in the long term, reducing demand and boosting unemployment. However, this is not the way out of the current situation, the governor pinpointed.

The UK is likely to be hit by a severe cost of living crisis already this April, instantly affecting the budgets of households and companies. The regulator's decision to raise interest rates is one of the reasons behind that. Domestic electricity costs could increase by 50% in April, and tax hikes aimed at balancing the country's finances (Brexit was costly) would hit the UK population even more.

Resolution Foundation, a think tank, has published a research paper, showing that a typical British household, on income of £27,000 after tax and housing costs, will pay £600 extra on energy bills and taxes alone. The Centre for Economic and Business Research projects an increase in the total annual cost of living by £1,980 - and that is before a tax hike.

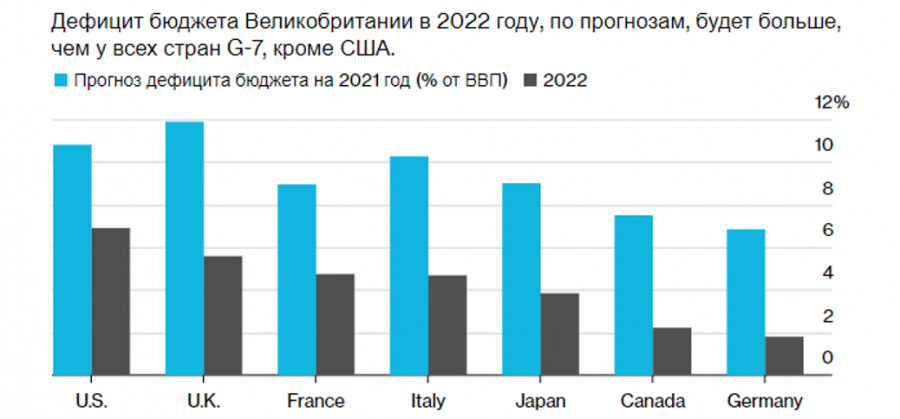

This year, UK households will pay around £14 billion of tax in the form of levies on health and social care. Another £12bn will come from businesses in 2023, following a corporate tax hike. Meanwhile, the UK budget deficit in 2022 is projected to be larger than that of all G7 countries except the US.

According to the Organization for Economic Co-operation and Development, the UK is ahead of Germany, France, Italy, and Spain in terms of budget recovery.

Lawmakers are already discussing the chances of Boris Johnson stepping down. The cost of living in the country is quickly becoming a key political battleground, posing a real threat to Boris Johnson.

Technical picture on GBP/USD

Bulls are now trading the pound less actively than they did yesterday. They should make a bigger effort if they want to break through 1.3645. A breakout is all bulls need to head towards the highs of 1.3685 and 1.3740. The nearest support level is seen at 1.3610. In case of a breakout there, the targets are seen at the lows of 1.3570 and 1.3530.

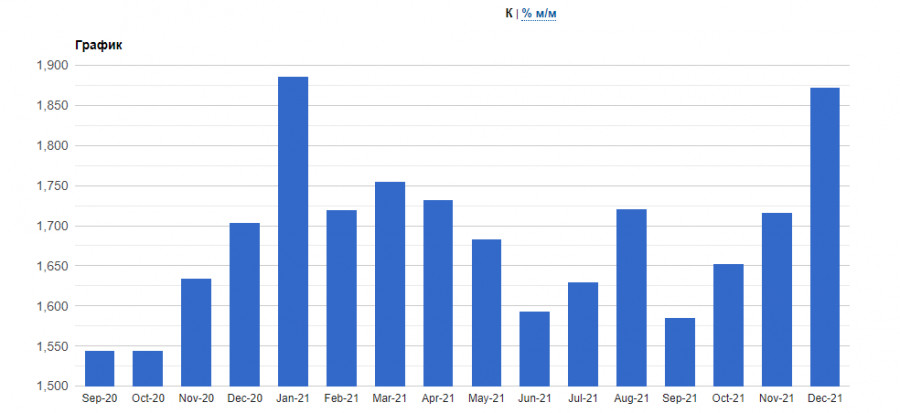

Speaking of yesterday's macroeconomic data in the US, housing starts for December were the only important report. According to the US Department of Commerce, housing starts increased by 1.40% m/m to 1.702 million in December, the highest since March 2021. The results beat market forecasts of a 1.7% fall to 1.65 million. Housing starts for November were revised down to 1.678 million versus 1.679 million.

Building permits in the country climbed 9.1% m/m to 1.873 million in December, exceeding market expectations of a 0.1% drop.

Demand for housing remains strong although high prices for building materials and supply constraints weigh on construction times. Expectations that the Federal Reserve will resort to aggressive policy tightening also provide support for the housing market.

Technical picture on EUR/USD

Bulls are trying to protect the support level of 1.1330. If the instrument goes below it, it could trigger a sell-off to the range of 1.1300 and 1.1260. In case the price consolidates above the resistance level of 1.1370, EUR/USD may head toward the highs of 1.1400 and 1.1440.