Conditions necessary to open long positions on EUR/USD:

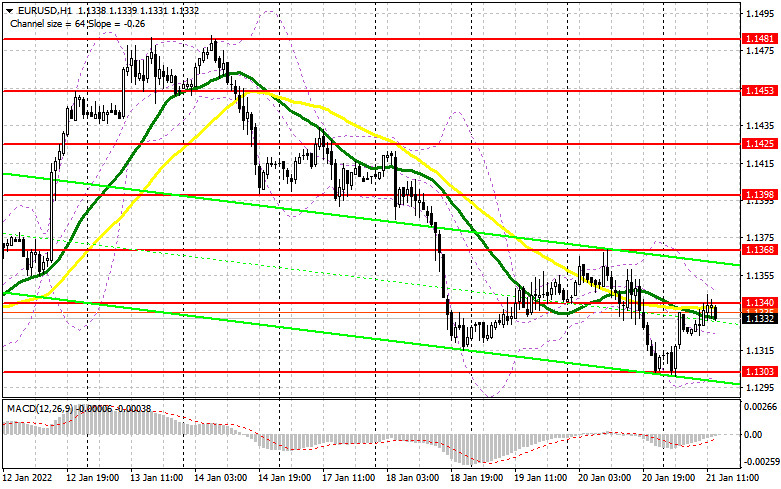

In the morning review, I recommended focusing on 1.1340 to decide when to enter the market. Let us look at the 5-minute chart and analyze the current situation. The absence of important macroeconomic data in the first half of the day prevented buyers of the euro from pushing the price above 1.1340. As a result, we saw a false breakout and a buy signal. However, at the moment of writing the article, the pair dropped by 10 pips. However, big players are not active in selling off the euro. The price is likely to hover below 1.1340 amid the existing pressure. From the technical point of view, the situation is the same. What entry points for the pound sterling did we have in the morning?

In the second half of the day, the US will disclose its reports, but they will hardly affect the euro or the greenback. Meanwhile, the speech delivered by Janet Yellen may influence the current state of affairs. She is likely to tackle risks caused by surging inflation. This, in turn, may prove the fact that the US Fed is planning to alter its monetary policy. It is a strong bearish signal for the euro/dollar pair.

If the pair declines, bulls should primarily protect the support level of 1.1303 that was tested today during the Asian trade. A false breakout of the level will provide traders with a buy signal. However, a large-scale correction may take place only after a break of 1.1340. The price will hardly climb above this level today. A downward break of 1.1340 may give additional signals to buy the asset. As a result, the price may recover to 1.1368 and 1.1398, where it is recommended to lock-in profits.

The level of 1.1425 is a farther target. If during the US trade, the pair declines and bulls fail to show interest at 1.1303, the pressure on the euro may advance. In this case, it is better to open long positions at a new low of 1.1273 after a false breakout. It is possible to buy the euro at 1.1248 and 1.1224 with the target of 20-25 pips on a daily chart.

Conditions necessary to open short positions on EUR/USD:

Today, sellers have successfully protected the resistance level of 1.1340. However, the euro is not showing an active decline. Until the pair trades below the mentioned level, there is a possibility of a drop to the bottom of pattern 13. A false breakout at 1.1340 will prove that big players are still in the market and are waiting for a decline in the euro in the short term.

An upward break of the level of 1.1303 will give an additional signal to open short positions with the target at 1.1273 and 1.1248. The level of 1.1224 is acting as a farther target, where it is recommended to lock-in profits. Notably, the pair may hit this level amid a massive sell-off of risky assets caused by intense discussions of further Fed's actions concerning the key interest rate. The issue could be tackled by Janet Yellen today. If the euro resumes climbing and bears remain passive at 1.1340, it will be better to open short orders after a false breakout at 1.1368. It is possible to sell the euro/dollar pair at 1.1398 or higher – at 1.1425 with the downward target of 15-20 pips.

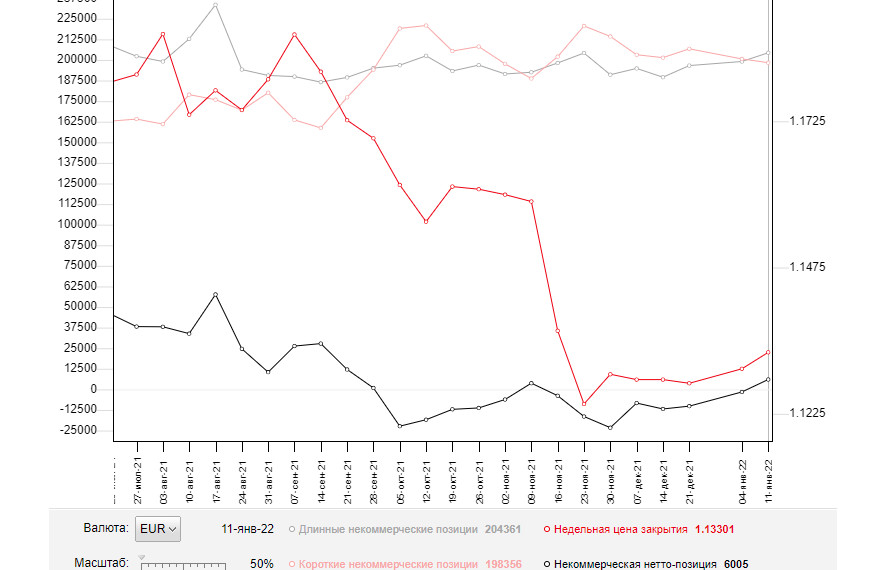

The Commitment of Traders report for January 11 disclosed a rise in the number of long positions and a drop in the number of short ones. The market situation is gradually changing and demand for the euro is still quite high despite possible changes in the Fed's policy.

Last week, the US unveiled its inflation figures. However, traders showed almost zero reaction since the data met forecasts. Against this background, Fed Chairman Jerome Powell provided casual comments on the key interest rate. Most traders had expected a more hawkish approach. At present, economists foresee three hikes of the benchmark rate. The first one will take place in March this year. A slump in the US retail sales logged in December, allowed the Fed not to hurry. At the same time, the ECB is planning to close its asset-purchasing program by the end of March. However, the regulator is not planning to take other measures aimed at tightening its monetary policy. This, in turn, is capping a rise in risky assets.

The COT reads that the number of long non-commercial positions advanced from 199,073 to 204,361, while short non-commercial positions fell from 200,627 to 198,356. This proves that traders are likely to continue to open more long positions on the euro in order to support the uptrend. At the end of the week, the total non-commercial net position became positive and amounted to 6,005 against -1,554. The weekly closing price rose slightly to 1.1330 against 1.1302 a week earlier.

Signals of indicators:

Moving Averages

Trading is conducted just below the 30- and 50-day moving averages, which indicates that the market remains under the control of sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

A breakthrough of the upper limit of the indicator in the area of 1.1350 may lead to a new jump in the euro. In case of a decline in the pair, the lower limit of the indicator in the area of 1.1300 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands (Bollinger Bands). The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total long position opened by non-commercial traders.

- Short non-commercial positions is a total short position opened by non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions opened by non-commercial traders.