What is needed to open long positions on GBP/USD

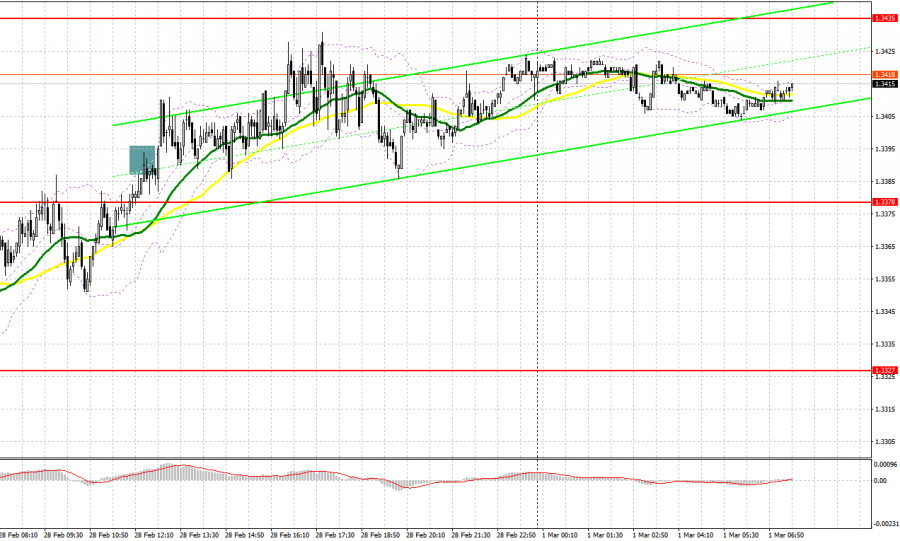

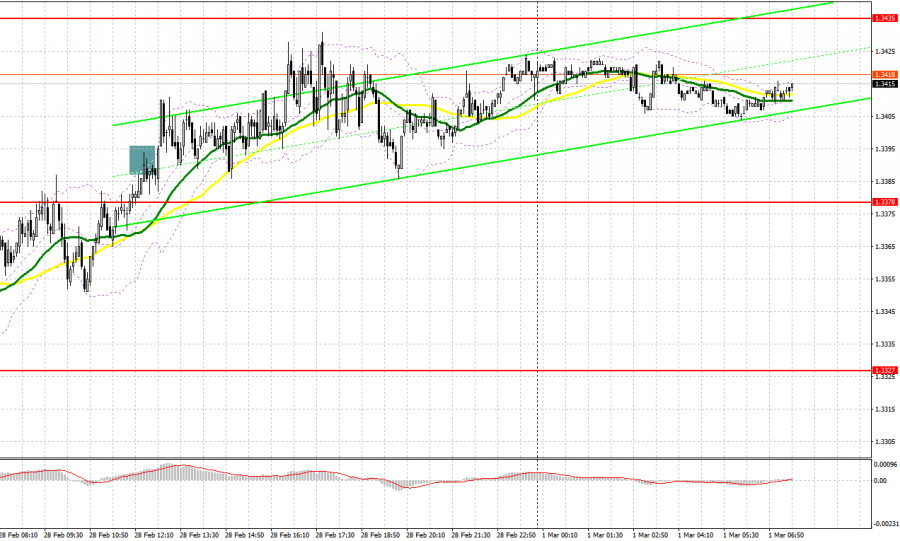

Yesterday, there was only one entry point for the pound sterling in the morning. Traders rushed to close positions and lock in profits. Let's look at the 5-minute chart and try to figure out what actually happened. In the morning article, I highlighted the level of 1.3389 and recommended making decisions with this level in focus. Demand for the pound sterling remained high at the beginning of the European session after a big drop in Asian trade. As a result, the price tried to break through the 1.3389 level. However, bears showed no energy at this level although there was a false breakout and a sell signal. To this end, no other entry points were formed.

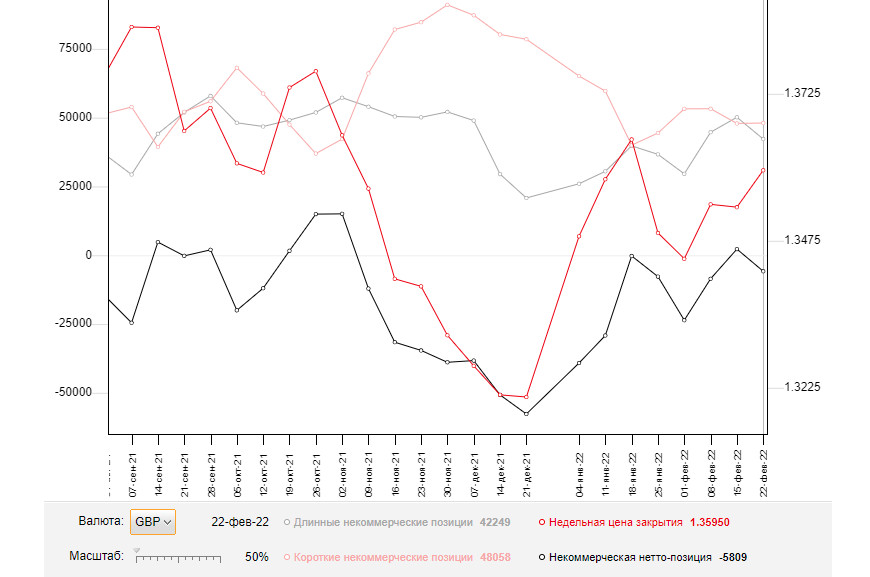

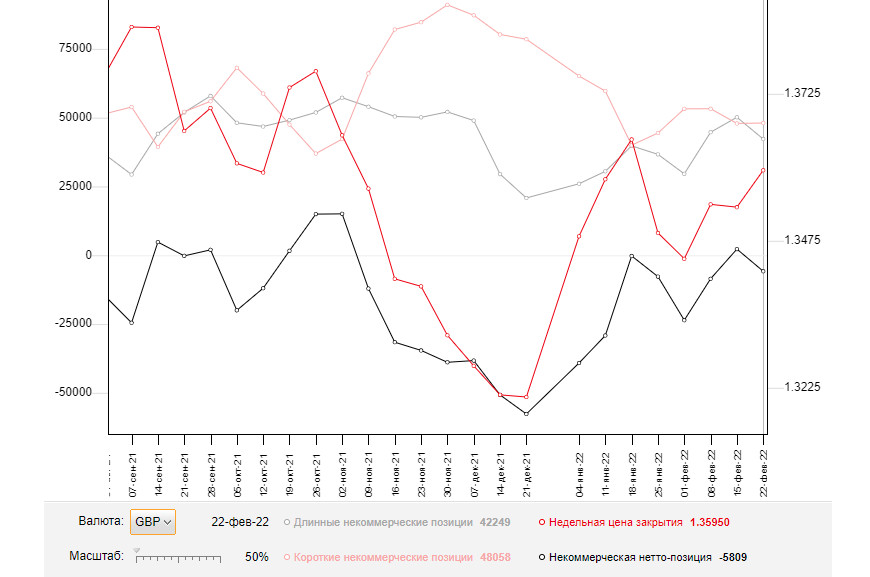

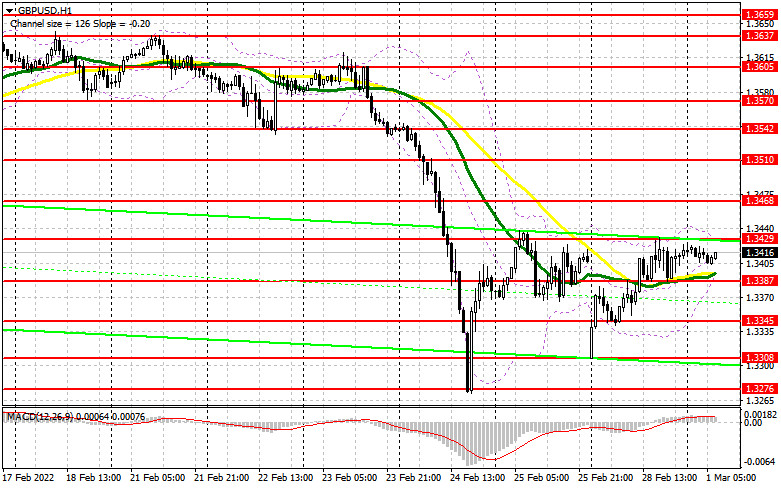

Before analyzing technical indicators, let's look at the results of the futures market. The COT report (Commitment of Traders) as of February 22 logged a sharp rise in short positions and a drop in long ones that triggered the negative delta. The market still maintains equilibrium despite tensions in Ukraine. As geopolitical tensions are heating up, it is not surprising that short positions on risky assets are constantly rising. Besides, the Russia-Ukraine conflict has affected almost the whole world. Notably, the report did not take into account a sell-off that took place at the end of last week. This is why we have now only preliminary figures. Currently, even the monetary policy decisions of the Bank of England or the Fed will be of no importance in case of an aggravation of the military conflict. Market sentiment is mainly influenced by this news. Russia and Ukraine agreed to return to the negotiating table. Naturally, everything will depend on the results of the meetings. The parties are going to hold more than one meeting. Therefore, the COT report is now less significant, especially given the fact that traders ignore fundamental data. I advise you to be careful about risky assets and buy the pound sterling only amid easing tensions between Russia, Ukraine, the EU, and the US. New sanctions against Russia will have serious economic consequences, which will inevitably affect financial markets. The COT report for February 22 revealed that the number of long non-commercial positions dropped to 42,249 from 50,151, while the number of short non-commercial positions climbed to 48,058 from 47,914. This led to the formation of a negative value of the non-commercial net position to 5,809 from 2,247. The weekly closing price rose to 1.3592 against 1.3532.

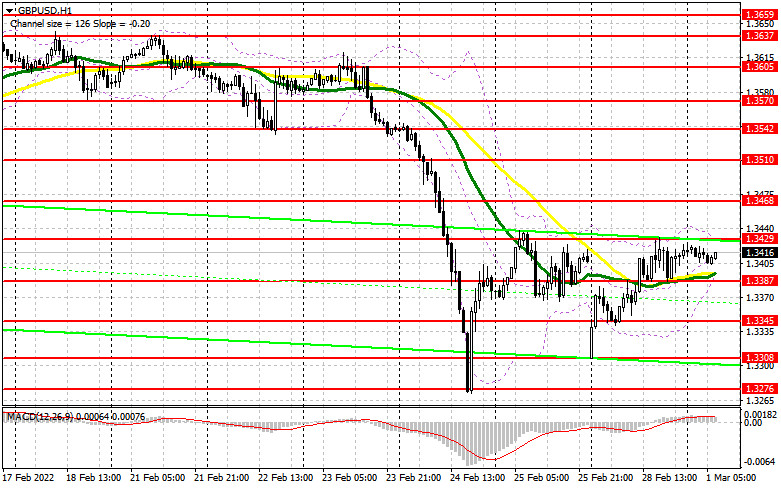

GBP bulls have almost no chances to cement an upward movement. The Manufacturing PMI Index is also unlikely to boost the pound/dollar pair. Its trajectory will mainly depend on the development of events in Ukraine and the results of negotiations between the two countries. The primary task of buyers today is to protect the support level of 1.3387 where the moving averages are passing in the positive zone. This is a psychologically important level as the return of the price below this level may undermine buyers' stop orders. Of course, it will increase pressure on the pair. In the case of a decline, a buy signal may appear only amid the formation of a false breakout at 1.3387, upbeat Manufacturing PMI data, and BoE policymakers' statements about the need to tighten monetary policy. Only these factors will help the pair maintain growth in the bear market because supported by geopolitical tensions. If this scenario comes true, the bulls will try to push the pair above the resistance level of 1.3429. Importantly, the air has been unable to break above this level since last Friday. The breakout and a downward test of this level will give an additional entry point and strengthen bullish sentiment. Thus, the price may rise to a high of 1.3468 with a prospect of an increase to the resistance level of 1.3510. A more distant target level will be 1.3542 where I recommend profit-taking. However, the pair is likely to reach this level only amid positive fundamental news and easing tensions. If the pound sterling slides down during the European session and bulls are lacking activity at 1.3387, bears may take the upper hand. Therefore, it would be better to cancel long positions until the level of 1.3345 or to the support level of 1.3308. Only the formation of a false breakout of these levels will give an entry point betting on the short-term growth of the pound sterling. It is recommended to open long positions on GBP/USD immediately on a rebound from 1.3276, keeping in mind an intraday correction of 20-25 pips.

What is needed to open short positions on GBP/USD

The bears are still defending the resistance level of 1.3429. They show no activity when the pair is steadily declining to the February lows. It means that there are fewer traders willing to sell the pound sterling even despite geopolitical turbulence. The deterioration of the geopolitical situation strengthens the bear market. If there is a reduction in tensions, the bears will quickly lose steam. As a result, the British currency will rapidly recover. You need to pay attention to it. Trading above the moving averages indicates that the market is now more bullish, albeit in the short term. This is why it is better to sell the pound. sterling. The primary task of the bears is to protect the 1.3429 level. It is the upper boundary of a wide sideways channel that originated after the pound sterling's drop last week. Downbeat UK Manufacturing PMI Index data and speeches made by Michael Saunders and Catherine L. Mann may help the sellers cement a downward movement. The formation of a false breakout at the level of 1.3429 will give an entry point into short positions with a downside target of 1.3387. Bears will have to fight hard for this level as moving averages are passing in the positive zone there. This level is also important for bulls. if they defend this level, the pair will start a correction. A breakout and an upward test of 1.3387 will lead to a drop in the number of stop orders, sending GBP/USD to the lows of1.3345 and 1.3308. A more distant target level will be 1.3276 where I recommend profit-taking. If the pair grows during the European session and sellers are lacking activity at 1.3429, it would be better to postpone sales until the resistance level of 1.3468. I also advise you to open short positions only in case of a false breakout. You can sell GBP/USD immediately on a rebound from a high of 1.3510 or even a higher high of 1.3542, keeping in mind a daily correction of 20-25 pips.

Signals of technical indicators

Moving averages

GBP/USD is trading above 30- and 50-period moving averages. It means that the bulls don't give up attempts to carry on with an upward correction.

Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart.

Bollinger Bands

A breakout of the upper border at about 1.3430 will trigger a new bullish wave of GBP. Alternatively, a breakout of the lower border at about 1.3387 will escalate pressure on GBP/USD.

Definitions of technical indicators

- Moving average recognizes an ongoing trend through leveling out volatility and market noise. A 50-period moving average is plotted yellow on the chart.

- Moving average identifies an ongoing trend through leveling out volatility and market noise. A 30-period moving average is displayed as the green line.

- MACD indicator represents a relationship between two moving averages that is a ratio of Moving Average Convergence/Divergence. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. A 9-day EMA of the MACD called the "signal line".

- Bollinger Bands is a momentum indicator. The upper and lower bands are typically 2 standard deviations +/- from a 20-day simple moving average.

- Non-commercial traders - speculators such as retail traders, hedge funds and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- The overall non-commercial net position balance is the difference between short and long positions of non-commercial traders.