Analysis of trades and trading tips

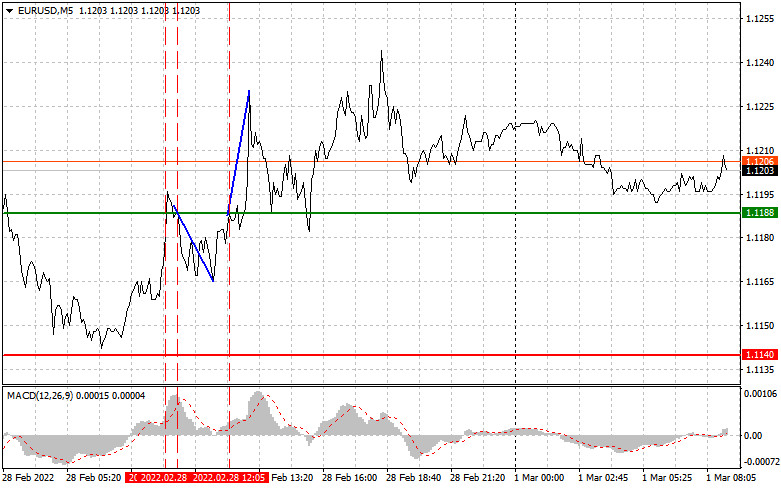

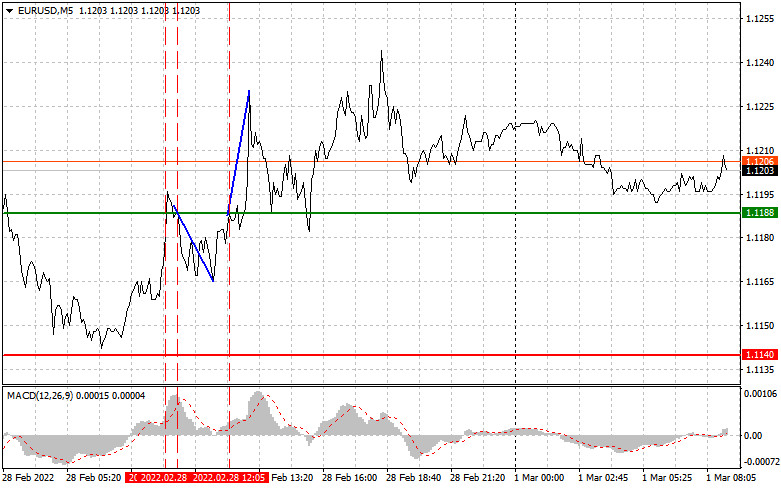

Yesterday, there were several gainful positions. The price tried to break through 1.1188 at the moment when the MACD indicator had already moved quite far from the zero level. It limited the upward potential of the pair. For this reason, I refrained from entering the market. After some time, the price made another attempt to break through the indicated level second. At that moment, the MACD indicator was already in the overbought area and began its decline. It led to the implementation of scenario No. 2 for opening short positions on the euro. The pair dropped by about 25 pips. Shortly after, closer to the middle of the day, the price tried again to test 1.1188. At that moment, the MACD indicator had just started to move up from the zero, level which was a confirmation of the correct entry point into long positions. The price rose by about 40 pips.

Yesterday, ECB policymakers delivered speeches, which had a positive impact on market sentiment. However, the pair resumed an upward movement mainly amid the start of negotiations between Russia and Ukraine. Although the parties failed to make some progress, they agreed to proceed with negotiations. As for the macroeconomic calendar, speculators ignored US trade balance data published yesterday. It is hardly surprising given that traders are now more focused on the Russia-Ukraine conflict than fundamental data. Today, Germany and Italy will unveil their Manufacturing PMI Indexes. The eurozone will release the same report. Christine Lagarde is scheduled to make a speech as well. Italy and Germany will also release the annual inflation reports, which may trigger volatility. If so, the euro may grow. In the afternoon, The ISM manufacturing index survey will be released. Analysts expect a strong reading in February, which will be bullish for the US dollar. The US will also publish its construction spending data, which is of little importance to traders, especially at the current time. The trajectory of the pair will depend on the development of events in Ukraine.

Buy signal

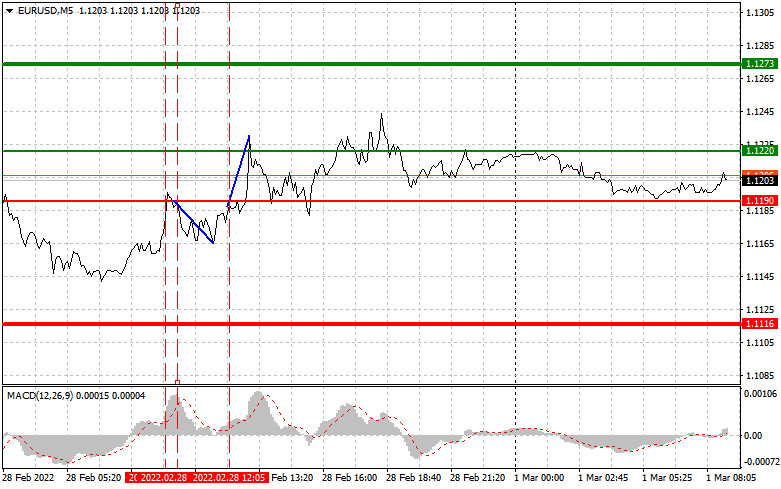

Scenario No.1: today, it is recommended to open long positions on the euro if the price reaches 1.1220 (the green line on the chart) with an upward target of 1.1273. I advise you to close long positions at 1.1273 and open short ones in the opposite direction, keeping in mind a 10-15 pip correction from the given level. The euro is unlikely to rise significantly today as tensions in Ukraine will barely ease. On the contrary, things are getting worse. Economic reports for the euro area will have little impact on the trajectory of the pair. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price approaches 1.1190. At that moment, the MACD indicator should be in the oversold area, which will limit the downward potential of the pair. It may trigger an upward reversal. The pair is expected to grow to the opposite levels of 1.1220 and 1.1273.

Sell signal

Scenario No.1: it is recommended to open short positions on the euro if the price hits the level of 1.1190 (the red line on the chart). The target level is located at 1.1116. I recommend closing short positions at this level and opening long ones immediately in the opposite direction, keeping in mind a 10-15 pip correction from the given level. The aggravation of the conflict between Russia and Ukraine will continue to weigh on the euro. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price reaches 1.1220. At that moment, the MACD indicator should be in the overbought area, which will limit the upward potential of the pair. It may also lead to a downward reversal of the market. The pair is expected to drop to the opposite level of 1.1190 and 1.1116.

Description of the chart

The thin green line shows the entry point to open long positions on the trading instrument.

The thick green line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to rise above this level.

The thin red line shows the entry point to open short positions on the trading instrument

The thick red line is the estimated price where you can place a Take profit order or lock in profits manually as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to pay attention to overbought and oversold zones.

Important. Novice traders need to make very careful decisions on entering the market. Before the release of important fundamental reports, it is better to stay out of the market to avoid losses due to sharp volatility. If you decide to trade during the news release, then always place stop orders to minimize losses. Without placing stop orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan like the one I presented above. Relying on spontaneous decision-making based on the current market situation is a losing strategy of an intraday trader.