The generally accepted point of view of the world's leading economists is that during the period of inflation, commodity markets will rise, and this is the bulls' chance to stay in the usual course. However, some analysts predict a fall in prices in this sector. Let's figure it out.

Commodity futures: an alternative view

As you know, stocks are getting cheaper, increasing the likelihood of a long-term bear market. Bonds also fell heavily in price. Foreign currencies fell sharply against the US dollar en masse. Cryptocurrencies, SPACs and other speculations have crashed in the wake of the tech stock market. But goods...

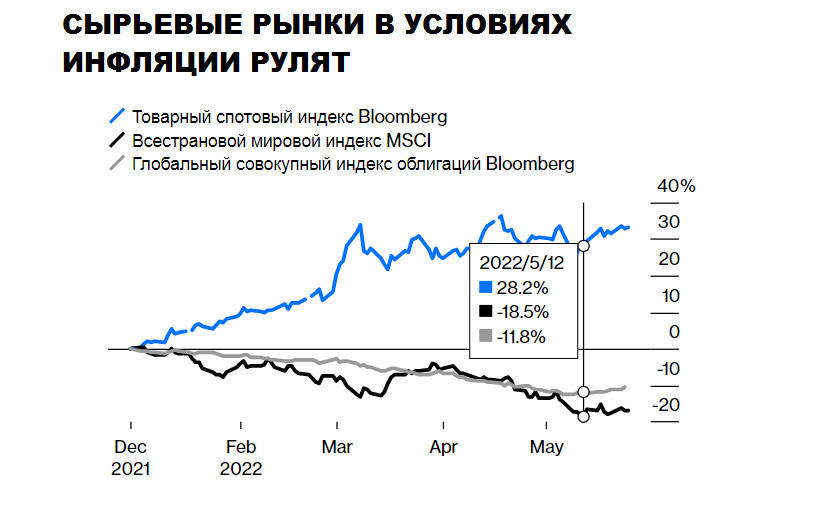

The Bloomberg Commodity Spot Index is up 33% this year, with prices for energy, metals and agricultural commodities posting the highest gains this year.

In principle, we observe a natural pattern of behavior in the market during a period of rising prices: investors, frightened by faster inflation, growing geopolitical risks and the accumulation of portfolio losses, are trying to invest in the commodity segment to hedge their portfolios.

Commodity ETFs have received $21.4 billion from this year through April, according to Morningstar. Compare that to the first four months of 2021, which saw outflows of $63 billion.

Today, however, some analysts are reconsidering the likelihood of a standard scenario that promises the greatest protection to investors in commodities.

Thus, Harry Schilling, an expert on leverage and venture capital, believes that bulls in the commodity market may soon regret their enthusiasm, as the forces of supply and demand may soon turn around.

Situation for today

You know the general touches of today's market: Covid-19 has led to ongoing lockdowns in China, resulting in a sharp decline in production in the world's second largest economy, which accounts for 18.1% of global gross domestic product and 23.9% of manufacturing. The damage extended to China's imports of goods from countries such as Brazil, Chile and Australia - oil, copper and iron ore - as well as manufacturing exporters such as Germany, South Korea and Taiwan. China's iron imports are already down 13% year-over-year in April, copper down 4%, and auto and chassis imports down 8%, according to Nomura Holdings, a research center.

In another part of the continent, a completely different factor is gaining power.

Russia's invasion of Ukraine has also disrupted global demand, and a strong dollar has hit commodity purchases in developing countries, as their currencies have been falling since April (by an average of 3% in April this year).

Of the 45 major commodities traded around the world, 42 are valued in dollars. The only exceptions are wool (Australian dollars), amber (Russian rubles) and palm oil (Malaysian ringgit), but amber occupies a small percentage of the commodity market.

Given this, imports of commodities in developing countries are declining at a fairly serious rate due to their growing need to use foreign exchange to service dollar-denominated debts.

The situation is complicated by the fact that dollar reserves are running low and debts have grown. For example, from 2018 to 2021, Chile's non-bank dollar debt rose from 34.7% of GDP to 50.3%, Mexico from 21.9% to 30.1%, and Turkey from 23.0% to 28.2% .

Therefore, it can already be seen that goods are also suffering, and the possible economic growth, according to generally accepted economic theory, favors services over goods.

This is clearly seen in a historical perspective.

Economic theories and pricing nuances

After World War II, Americans' spending on goods fell from 61% of household spending to 35%, while spending on services rose from 38% to 65%. This is also true for rapidly developing countries such as China.

On the supply side, the standard theory is that periods of inflation still push commodity prices higher.

But in fact, in gold terms, with the exception of a brief rise during the wars and oil embargoes of the 1970s, inflation-adjusted prices have steadily declined since the mid-1800s, by a total of 83%.

This is due to the development of industry in many regions, meeting the needs, competition and robotization of labor. Substitutes and productivity improvements have always beaten the threat of shortages over the past two centuries - since the beginning of the industrial revolution.

As you know, the truth is always in the details, so one must also take into account that the prices of agricultural and industrial goods often fall together, as a drop in demand for wheat, for example, leads to a drop in demand for tractor parts.

On the other hand, high prices are the best fertilizer for crops as well as other commodities: high prices for the same wheat encourage farmers to expand their arable land by planting as much as possible.

But immediately after this bumper harvests inevitably reduce prices.

Similarly, high pork prices encourage sow breeding, especially if corn prices are low. Then the oversupply of pigs drives down the price of pork chops. Even low prices can stimulate more supply. Low sugar prices are prompting Brazilian farmers to plant and harvest more sugar cane to support overall income.

But there are also many additional factors that can negate the preliminary calculations of traders. Bad weather can negate high crop yields.

Cartels and associations can also contribute to violations. Everyone remembers the summer of 2021 and OPEC+'s refusal to increase production.

In addition, US oil companies are not responding to high oil prices with additional drilling. Instead, shareholders and their own compensatory incentives encourage production cuts to boost profitability. Companies are paid to cut costs and save cash to pay off debt, pay dividends, and buy back their shares. All this makes it difficult to predict the price of oil, as well as other commodities.

But there is an additional factor in stock trading: traders tend to be on the same side of trading the same commodities at the same time. For example, a speculator suffering large losses in zinc positions is forced to sell wheat stocks to save capital, like others.

Commodity rollback is not such an impossible event

Harry himself notes that while he himself prefers short positions in copper futures, which have already fallen by 14% compared to the peak of early March, although this is a rather risky tool.

Copper is used in almost every industrial product, from cars, appliances and computers, so it's a great indicator of the global recession that is on the horizon.

Importantly, copper does not currently have a cartel on either the supply or demand side that could disrupt fundamental economic forces and nullify traders' forecasts with unexpected positional decisions.

As a result, after several failed years, higher copper prices and reliable demand forecasts, as usual, stimulated the opening of new mines and processing facilities. The International Copper Research Group expects the copper market to have a huge surplus of 328,000 metric tons this year after a deficit of 475,000 metric tons in 2021, meaning that copper will continue to fall in price.

Yes, copper bulls are predicting increased demand in the coming years from EV batteries and other electrical appliances. But this is only one side of the coin.

But what will be the demand for electric vehicles during a recession? Of course, rising vehicle prices will not only make Germany nervous, forcing manufacturers to reduce production volumes, and hence contracts for the supply of copper.

And although the demand for wheat is likely to remain high due to the danger of famine in the third world countries, as well as the inability of Ukraine to increase the area under crops (taking into account the loss of several regions). However, oil and gas may also turn out to be not so scarce - amid limited demand from producers in the EU, on the one hand, and the possible end of the conflict between Russia and Ukraine (or the transition to a protracted positional confrontation, which will also equalize prices and take care of filling the deficit ).

As far as long-term projections go, never underestimate the power of technology development. Not so long ago, we all thought that the growth of electricity distribution was limited by the fact that there was not enough copper in the earth's surface to make all the necessary wires. And then came fiber optics made from silicone, the world's second most abundant mineral, and the problem was quickly solved. Bet on human ingenuity and you will be ahead of the markets, not trail behind.